What is Gap?

A gap on a price chart occurs when the price makes a sharp move up or down with no trading in between. Gaps can be caused by factors such as regular buying or selling pressure, earnings announcements, changes in an analyst’s outlook, adverse financial or economic developments, or any other type of news release.

Forex gaps can happen at any time as long as there is a disconnection in the currency pair’s price.

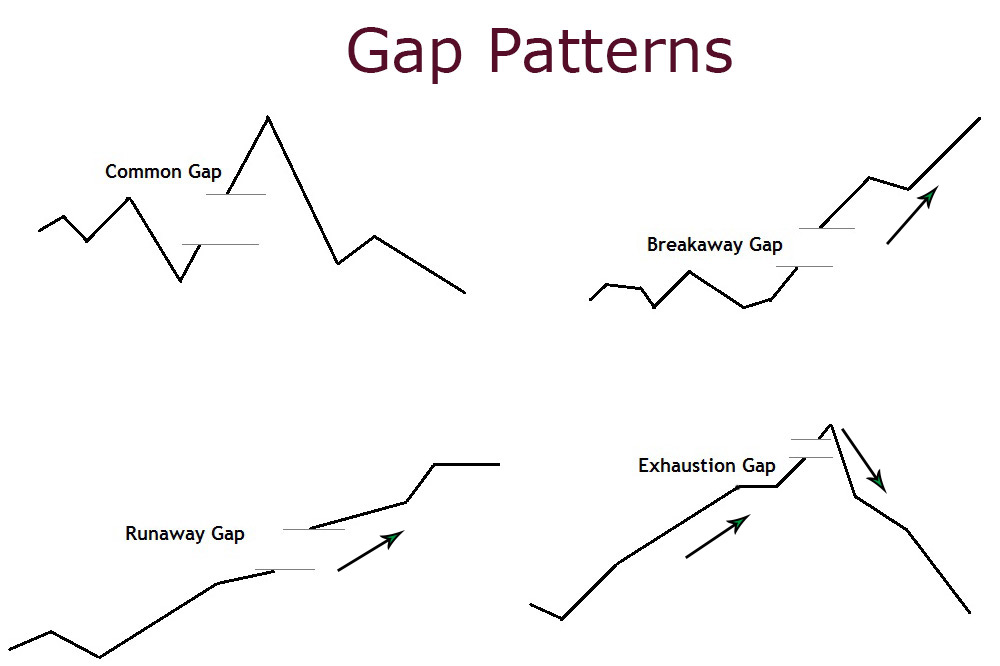

There are four types of gaps in forex trading:

Common Forex Gaps: These gaps are caused by normal market forces and, as the name implies, are very common. They are represented graphically by a non-linear jump or drop from one point on the chart to another.

Breakaway Forex Gaps: A breakaway gap occurs in the movement of a stock price and is supported by high volume levels.

Runaway Forex Gaps: These gaps occur during strong bull or bear movements and are characterized by an abrupt change in price appearing over a range of prices. They are caused by a sudden increase or decrease in interest in a stock.

Exhaustion Forex Gaps: These gaps occur after a rapid rise in a stock’s price begins to fall off. An exhaustion gap usually reflects falling demand for a particular stock.