What are the different types of Forex brokers?

Estimated reading: 2 minutes

5324 views

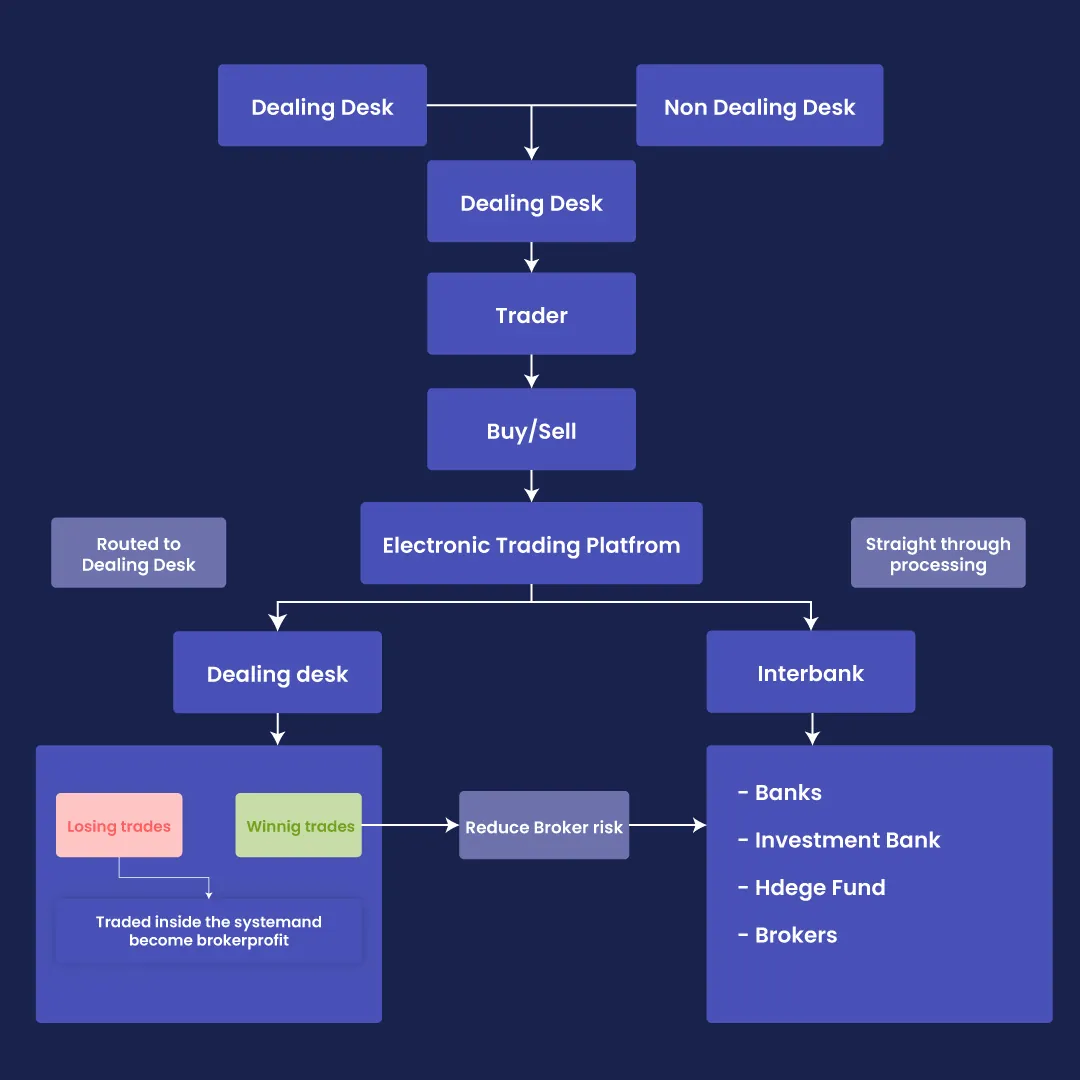

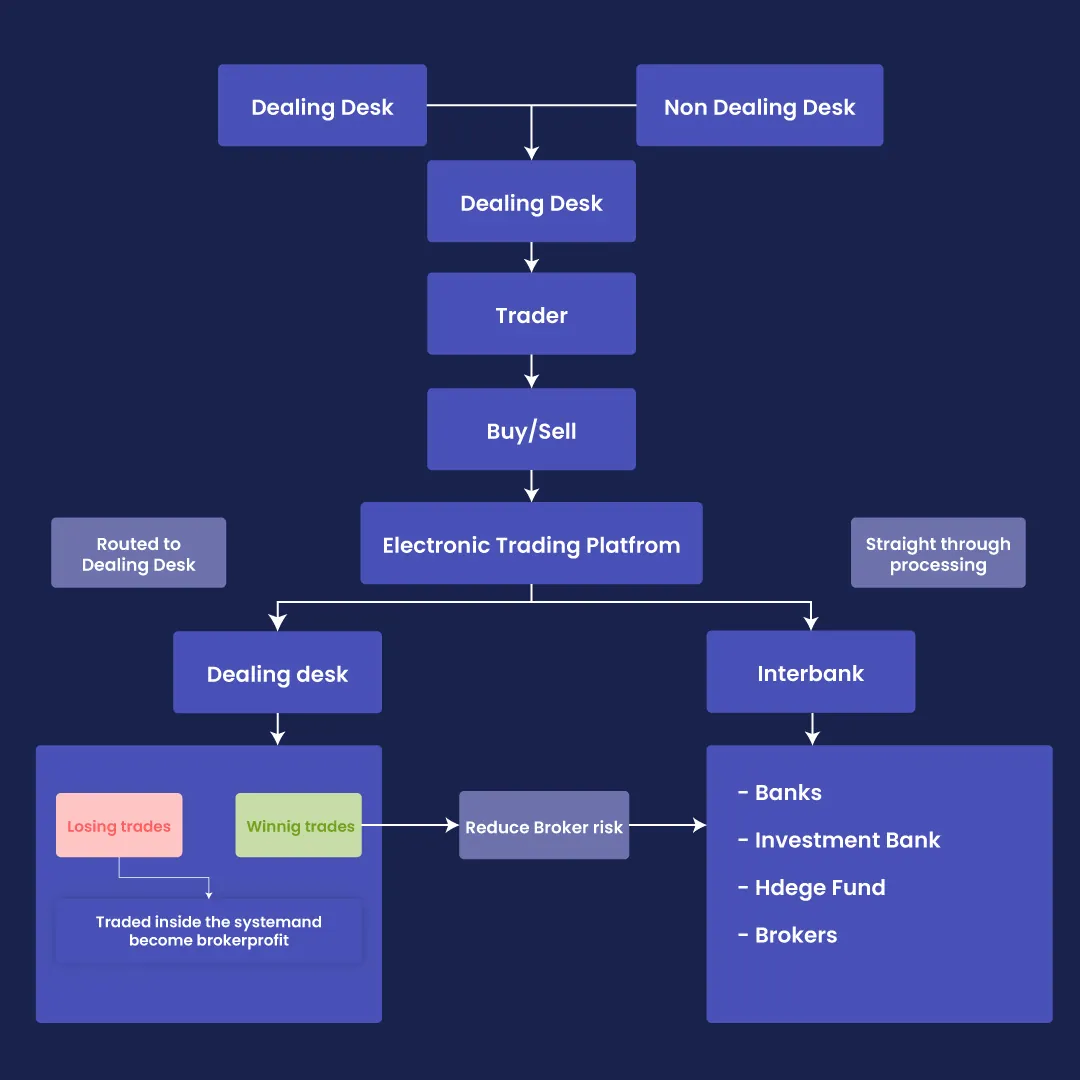

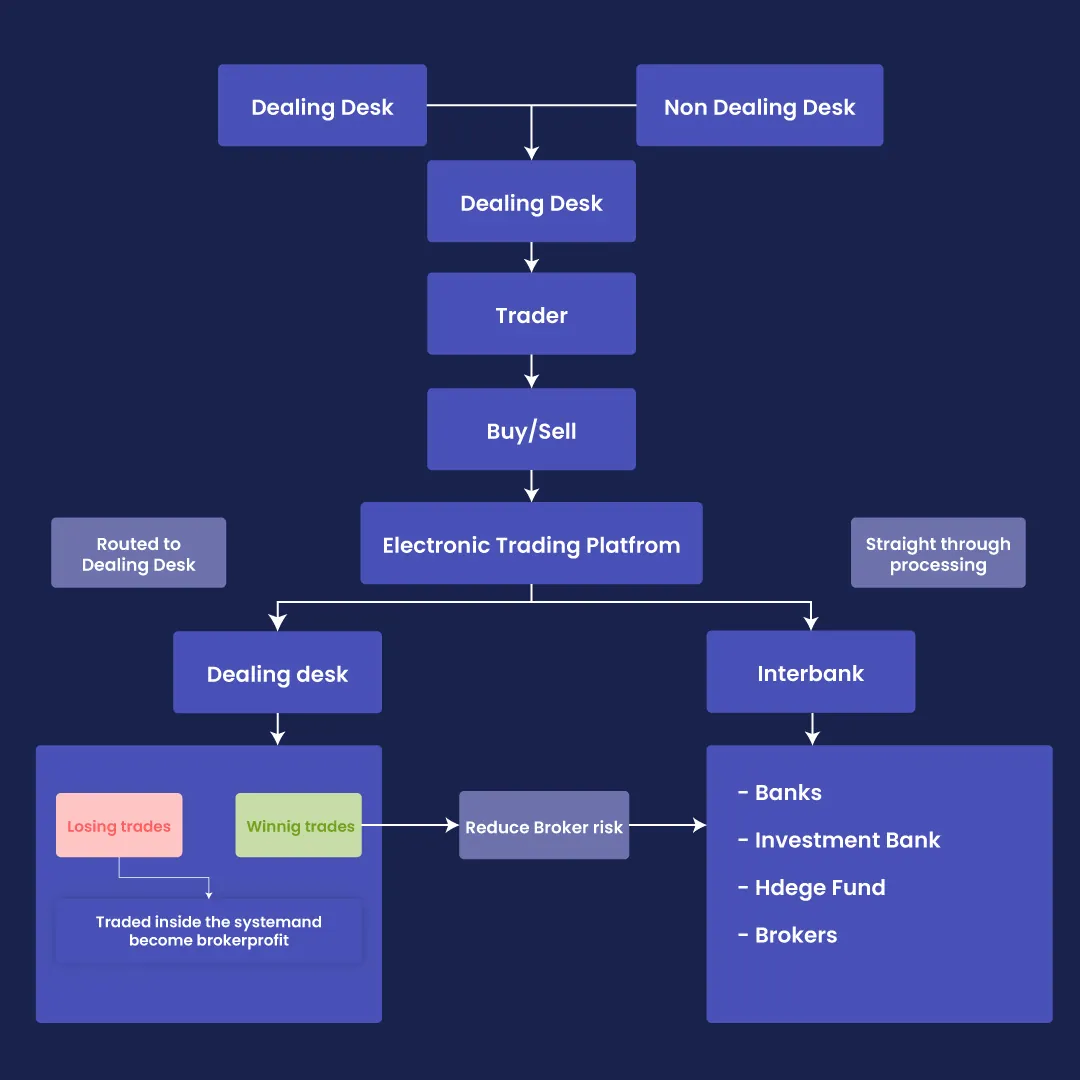

The types of Forex brokers: ECN – STP – NDD – DD

Powered By EazyDocs