Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/USD pair is sensitive to a variety of economic indicators from both the Eurozone and the United States, such as GDP growth rates, employment data, and central bank decisions. Current trends in trade relations and political developments within Europe, like Brexit negotiations or elections, can have significant impacts. Additionally, the US dollar is affected by the Federal Reserve’s monetary policy, inflation rates, and international trade tensions.

Price Action:

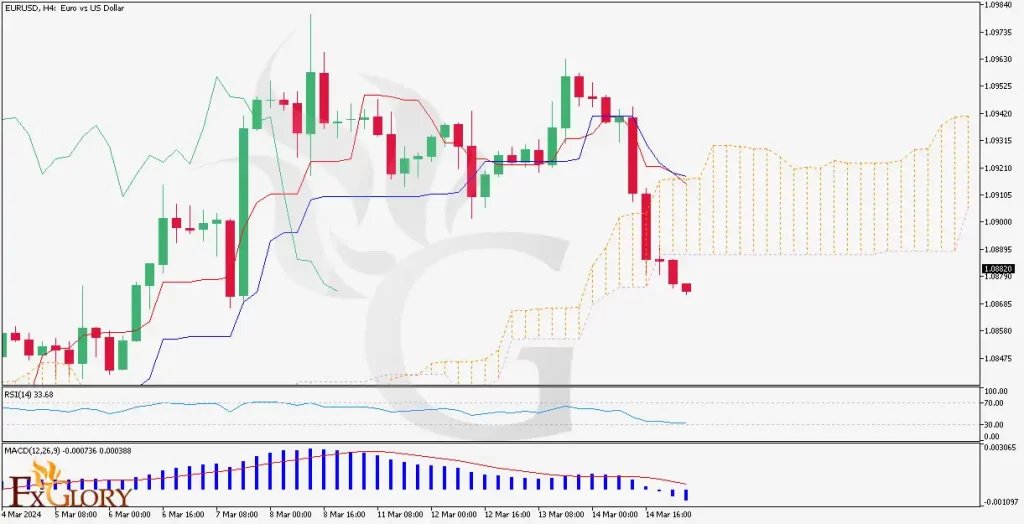

Looking at the EUR/USD on the H4 chart, the pair has been exhibiting a downtrend, marked by consecutive lower highs and lower lows. The price action is currently showing a bearish bias, with recent candles forming a downwards pattern.

Key Technical Indicators:

RSI (Relative Strength Index): The RSI is below 40, which suggests that the market may be in an oversold condition, potentially signaling an upcoming pause or reversal in the downtrend.

MACD (Moving Average Convergence Divergence): The MACD line is below the signal line, and the histogram is in negative territory, which indicates bearish momentum.

Ichimoku Cloud: The price is below the cloud, and the cloud appears to be expanding, which traditionally indicates a strong downtrend.

Support and Resistance:

Support: The recent low provides a potential support level, while a further decline would see the next level of historical support come into play.

Resistance: The base of the current decline acts as the first level of resistance, followed by the lower boundary of the Ichimoku cloud.

Conclusion and Consideration:

The EUR/USD H4 chart points to a bearish outlook based on both the price action and the technical indicators. The MACD suggests that the bearish momentum may continue, while the RSI implies a potential for a reversal due to oversold conditions. If considering a trade, one might look for potential buy signals if the RSI starts to climb back above oversold levels, while also keeping an eye on the MACD for shifts in momentum. However, fundamental factors from both the Eurozone and the US should be monitored closely, as they could swiftly alter market sentiment. As always, employing sound risk management strategies is crucial in managing the inherent risks of Forex trading.

Disclaimer: This analysis is informational and does not constitute investment advice. Traders should do their own research before making any trading decisions.