Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/JPY exchange rate analysis reflects interactions between the Euro and the Japanese Yen, influenced by economic, political, and geopolitical events within Europe and Japan. Upcoming economic releases like Spanish Unemployment Change, French and German Services PMIs, and German Trade Balance are poised to impact the Euro. These indicators, coupled with speeches from European central bank officials, could sway EUR/JPY dynamics, particularly through shifts in investor sentiment and intra-day trading volatility.

Price Action:

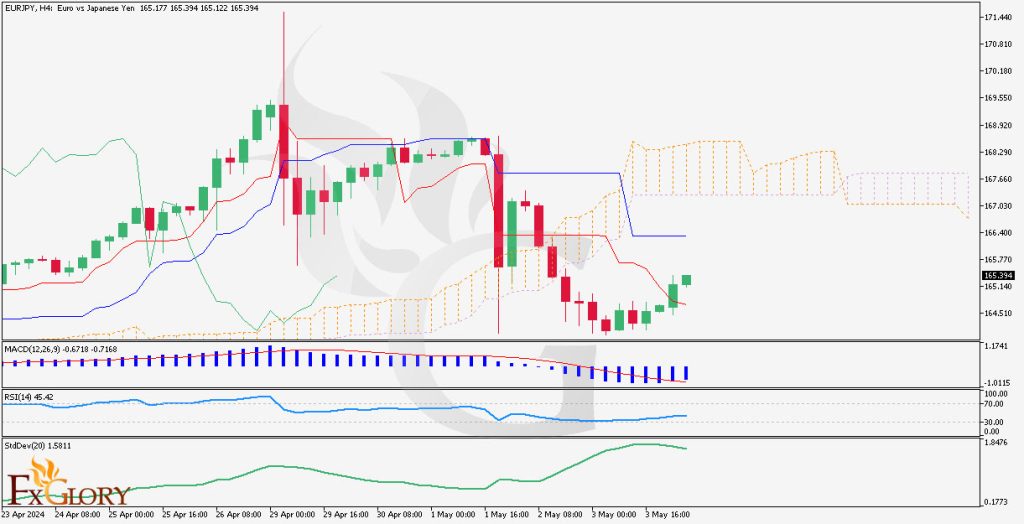

The recent trading sessions on the H4 chart show a pullback with the last three candles closing higher, suggesting a potential recovery or a short-term bullish reversal in EUR/JPY. The current candle formation indicates a continuation of this trend with a slight uptick in buying pressure, possibly challenging the upper levels of recent trading ranges.

Key Technical Indicators:

Ichimoku Cloud: The price is below a thickening cloud, indicating potential resistance overhead. This suggests a bearish sentiment in the medium term.

MACD: The MACD line has crossed below the signal line but shows signs of curling upwards, hinting at a possible regain in upward momentum.

RSI (14): The RSI is at 45, reflecting neither overbought nor oversold conditions but indicates the potential for price recovery following recent declines.

Standard Deviation (20): Currently at 1.5811, suggesting moderate market volatility and some degree of price instability.

Support and Resistance:

Support: The recent lows around 164.480 provide a short-term support level.

Resistance: The recent high near 168.290 and the lower boundary of the Ichimoku cloud serve as resistance levels.

Conclusion and Consideration:

The EUR/JPY technical analysis chart currently displays potential for a short-term bullish recovery within a broader bearish context. The upcoming European economic news could introduce volatility, influencing the pair’s short-term trajectory. Traders should monitor these releases closely, as positive news may strengthen the Euro, testing resistance levels, while negative news could reinforce the bearish trend. Risk management and vigilant monitoring of economic indicators are advisable.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.