Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/USD pair is heavily influenced by economic releases from both the Eurozone and the United States. Today’s focus is on critical U.S. economic data: Average Hourly Earnings, Non-Farm Employment Change, the Unemployment Rate, and ISM Services PMI. These indicators are significant as they provide insights into economic health and labor market conditions in the U.S., potentially affecting Federal Reserve’s monetary policy decisions and thus, the strength of the USD.

Price Action:

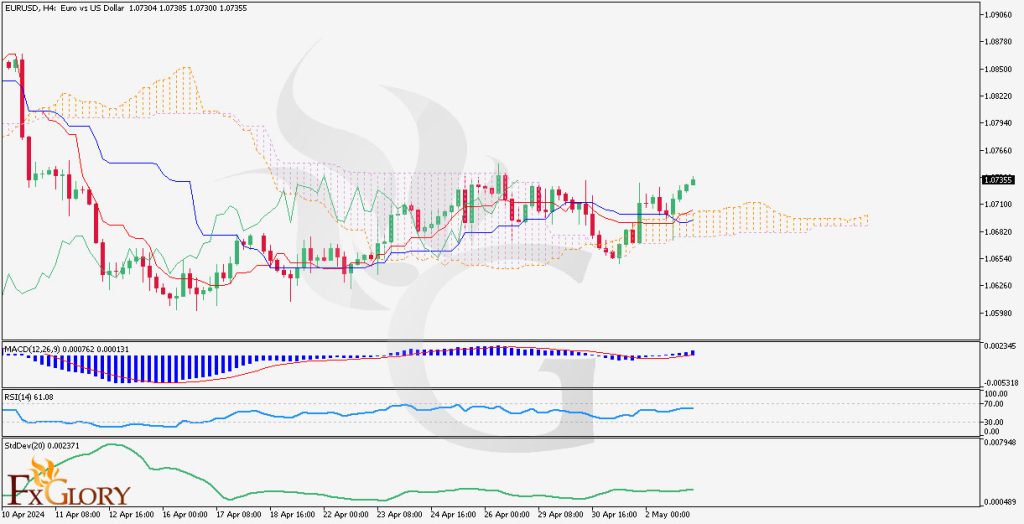

The EUR/USD shows an uptrend in the recent 4-hour candles, suggesting bullish sentiment. The consistent appearance of green candles indicates active buying pressure in the market, with the latest candle still forming positively.

Key Technical Indicators:

Ichimoku Cloud: The price is above the Ichimoku Cloud, signaling bullish conditions. However, the thinning cloud ahead could indicate a potential change in volatility or a weakening of the current trend.

MACD (Moving Average Convergence Divergence): The MACD is above its signal line and has crossed into positive territory, supporting the ongoing bullish momentum.

RSI (Relative Strength Index): The RSI stands at 61, indicating a strong buying momentum, yet still below the overbought threshold, suggesting there might be room for upward movement.

Standard Deviation (StdDev): The increasing StdDev points to heightened volatility, correlating with significant price moves.

Support and Resistance:

Support: Current support can be identified around the 1.07300 level, where previous lows have found stability.

Resistance: Immediate resistance is seen around the 1.07950 level, aligning with recent peaks.

Conclusion and Consideration:

The EUR/USD shows a bullish pattern, supported by both technical indicators and the anticipation of today’s U.S. economic reports. Traders should remain vigilant of the outcomes of the U.S. data releases as they could inject volatility and drive significant market reactions. The potential for fluctuation is notably high, and positions should be managed with a keen eye on risk and exposure to sudden shifts in market sentiment.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.