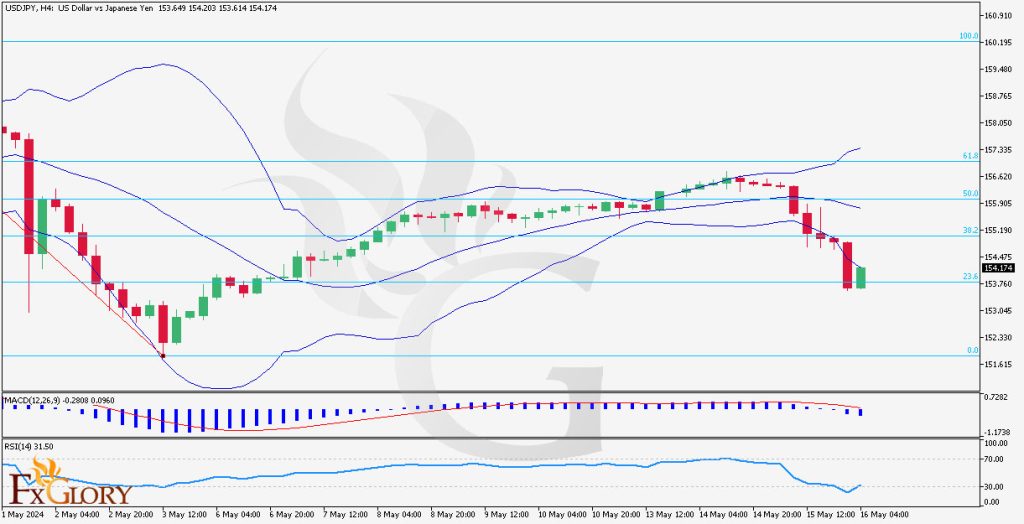

Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The USD-JPY chart analysis is influenced by economic indicators from both the U.S. and Japan. Recent Japanese economic data shows a contraction in GDP with the Preliminary GDP q/q at -0.5% versus the forecast of -0.3%. This indicates weaker economic activity, which generally weakens the JPY. Additionally, the GDP Price Index came in higher than expected at 3.6%, suggesting rising inflation which can pressure the Bank of Japan to adjust monetary policy. The Revised Industrial Production m/m came in below expectations, signaling weaker industrial output, which further weighs on the JPY.

In the U.S., high-impact news includes Jobless Claims with a forecast of 219k. A lower-than-expected figure would be positive for the USD as it indicates a stronger labor market. Additionally, the Building Permits and Philly Fed Manufacturing Index, both of medium impact, will provide insights into the housing market and manufacturing sector’s health. The Industrial Production m/m data will also be crucial as it indicates the overall industrial output, and a figure higher than the forecast of 0.1% could further strengthen the USD. Positive economic indicators from the U.S. could support the USD, especially against the backdrop of weaker Japanese data.

Price Action:

On the H4 timeframe, the USD/JPY analysis shows a marked downtrend characterized by successive lower highs and lower lows. Recently, there has been a slight recovery with the formation of a bullish candle, suggesting a possible retracement or reversal in the short term. However, the broader trend remains downward as indicated by the overall movement and the positioning of the latest price below previous resistance levels.

Key Technical Indicators:

Bollinger Bands: The bands have been widening recently, indicating increasing volatility. The price is currently near the lower band, which could suggest a potential rebound or consolidation at this level.

MACD: The MACD line is below the signal line and close to the zero line, signaling bearish momentum. However, the histogram shows a slight decrease in bearish momentum, which may suggest a possible slowdown in the downtrend.

RSI: The RSI is at 31.50 and moving upwards, indicating that the pair is close to oversold territory. This upward movement can signal a potential reversal or at least a pause in the current downtrend.

Support and Resistance:

Support: Immediate support is around 153.760, with stronger support at 151.615, which aligns with recent lows.

Resistance: Initial resistance is around 154.475, with more significant resistance at 155.905, near the mid-range of the Bollinger Bands and the 50% Fibonacci retracement level.

Conclusion and Consideration:

The USD/JPY daily chart analysis is currently in a bearish trend on the H4 chart, with indicators showing potential for short-term support or a minor rebound. The fundamental usdjpy outlook favors the USD due to weaker Japanese economic data and potential positive U.S. economic reports. Traders should monitor key support and resistance levels closely, along with upcoming U.S. economic data releases, to identify potential trading opportunities and manage risk effectively. Given the current technical setup, cautious optimism for a short-term bounce could be warranted, but the overall bearish trend suggests remaining vigilant for further downside risks.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.