Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EURUSD pair reflects the relationship between the European and US economies. Key economic indicators from both regions, such as GDP growth rates, employment data, and inflation rates, directly influence its value. The European Central Bank and Federal Reserve monetary policies, particularly interest rate decisions and quantitative easing measures, are critical drivers of the pair’s movements. Additionally, political stability and economic sentiment within the Eurozone, alongside trade balance data, can affect the euro’s strength.

Price Action:

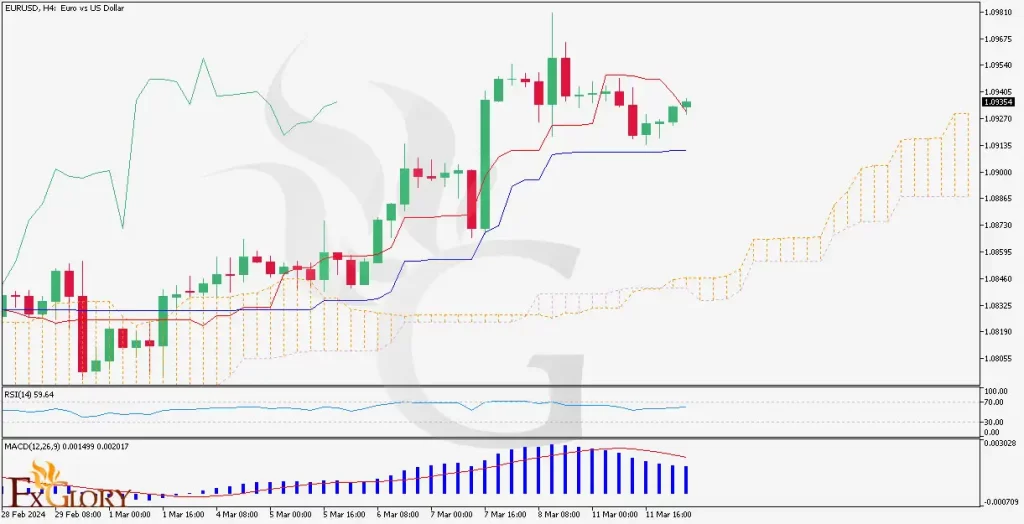

The EURUSD H4 chart indicates a consolidation pattern following a bullish run, suggesting indecision in the market. The recent candles are shorter, showing less volatility and a struggle between buyers and sellers to establish control. The price remains above the Ichimoku cloud, supporting a generally bullish sentiment, but the recent pullback warrants caution for continued upward movement.

Key Technical Indicators:

Ichimoku: The price is above the Ichimoku cloud, and the Tenkan-sen is above the Kijun-sen, indicating a bullish trend but with possible short-term consolidation.

RSI: With an RSI reading near 59, the market is neither overbought nor oversold, providing no strong momentum signals currently.

MACD: The MACD line is above the signal line but converging, suggesting the bullish momentum may be waning as the histogram bars decrease in height.

Support and Resistance:

Support: The lower boundary of the Ichimoku cloud acts as immediate support, followed by a stronger historical support level at the 1.0895 mark.

Resistance: Immediate resistance is presented by the most recent high around 1.0935, with further resistance likely near the 1.0954 area, which has historically been a pivot point.

Conclusion and Consideration:

The EURUSD on the H4 timeframe is showing signs of a bullish trend losing momentum, as indicated by the MACD and the price action within the Ichimoku cloud. Traders should look for potential entry points if the price respects the cloud as support. However, given the approaching resistance and the RSI indicating a lack of strong momentum, it’s crucial to monitor upcoming economic reports from the US and the EU that may impact volatility and direction. Risk management strategies should be a priority in preparation for possible breakouts or reversals.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.