Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Today’s fundamental outlook for NZDUSD is marked by critical economic data from both New Zealand and the United States. On the USD side, traders will closely monitor the release of Residential Building Permits and Housing Starts, indicators that reflect the health of the U.S. housing market. Additionally, the Import Price Index will provide early inflation insights, while the University of Michigan’s Consumer Sentiment and Inflation Expectations data may affect market sentiment toward the USD. Moreover, Richmond Fed President Thomas Barkin’s speech will be scrutinized for insights into future Fed monetary policy. In New Zealand, traders will pay attention to BusinessNZ’s Performance of Manufacturing Index (PMI), which could indicate economic expansion or contraction and influence the NZD’s strength.

Price Action:

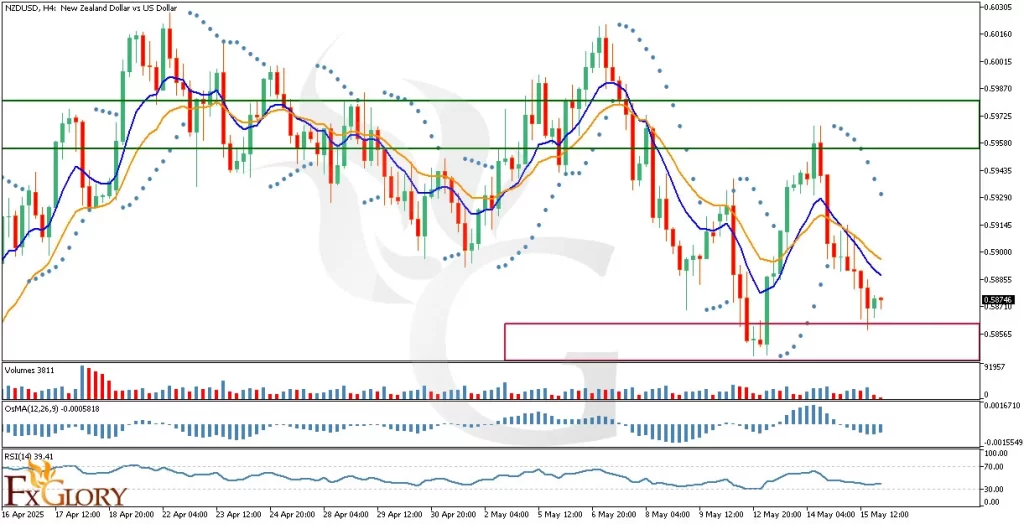

Analyzing the NZD/USD pair on the H4 timeframe indicates a clear bearish trend through recent price action. The market has consistently formed lower highs and lower lows, confirming ongoing selling pressure. The most recent candles display bearish momentum, with price action struggling to break above moving average resistances, and continuously testing support near recent lows. The candlestick patterns suggest the bears remain in control, albeit with some hesitance approaching the immediate support area.

Key Technical Indicators:

Parabolic SAR: The Parabolic SAR indicator distinctly illustrates the bearish sentiment as its last 8 dots have consistently been placed above the price candles. This alignment signals continuing downward pressure and indicates that sellers are maintaining their dominance, suggesting further bearish continuation is likely unless a bullish reversal is clearly established.

Moving Averages (MA 9 & MA 17): The moving averages confirm the bearish scenario; the short-term MA (9, blue line) recently crossed below the longer-term MA (17, orange line), a classic bearish crossover indicating continued selling pressure. As the price remains below both MAs, bearish momentum remains strong and intact.

Volumes: The Volumes indicator is showing decreased buying activity with slightly increasing volume on bearish candles, signifying stronger selling pressure at current price levels. This suggests that bearish sentiment persists, with market participants leaning towards further downside movements.

OsMA (Moving Average of Oscillator): The OsMA indicator currently shows bars below the zero line and increasing in negative magnitude, reflecting growing bearish momentum. Such negative divergence reinforces the potential for further downward movement, indicating sellers are likely to maintain control in the short term.

RSI (Relative Strength Index): The RSI is currently at 39.41, trending downward but not yet in oversold territory. This signifies that while the bearish sentiment is clearly strong, the pair still has room to continue falling before becoming oversold, which would signal caution for potential reversals or consolidation.

Support and Resistance:

Support: Immediate support is identified at the 0.58585-0.58710 zone, a critical area where recent lows have formed.

Resistance: The nearest resistance levels are at 0.59350 and subsequently at 0.59750, where previous swing highs and consolidation phases occurred.

Conclusion and Consideration:

The NZD USD H4 chart analysis continues to reflect a bearish trend, supported strongly by the Parabolic SAR, moving averages crossover, and negative OsMA. Traders should consider short positions, particularly if the immediate support at 0.58585 is breached with conviction. However, caution is advised ahead of significant fundamental news today from both NZD and USD, as these events could trigger increased volatility and potential reversals or corrective moves.

Disclaimer: The analysis provided for USD/NZD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on USDNZD. Market conditions can change quickly, so staying informed with the latest data is essential.