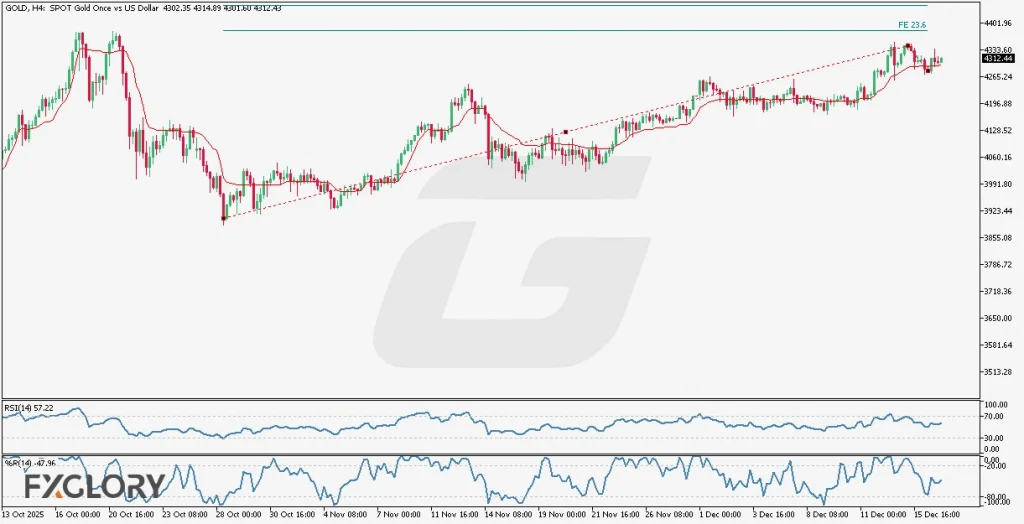

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Gold prices are sensitive today due to crucial announcements from Federal Reserve officials. Federal Reserve Governor Christopher Waller, New York Fed President John Williams, and Atlanta Fed President Raphael Bostic are scheduled to speak, potentially affecting USD volatility. Any hawkish sentiment expressed could strengthen the USD, inversely impacting gold prices. Additionally, the EIA crude oil inventory release might influence broader market sentiment and indirectly affect gold.

Price Action:

The GOLD/USD pair analysis on the H4 timeframe indicates a dominant bullish trend characterized by robust upward movements and shallow corrections. The recent candles suggest the completion of a corrective phase and signal a renewed bullish momentum, supported by the latest bullish engulfing candle. The Fibonacci expansion level at 23.6, coinciding with a recent high, could act as significant resistance, prompting another potential corrective move.

Key Technical Indicators:

Adaptive Moving Average (9): Currently positioned below the candles, this moving average strongly supports continued bullish momentum, acting as dynamic support.

RSI (14): Currently at 57.22, the RSI signals moderate bullish strength. The indicator has room to rise further before indicating an overbought market, suggesting potential upward continuation.

William’s %R: Currently at -47.96, William’s %R indicates the market is approaching neutral territory after recent bullish momentum. This condition supports further bullish activity before hitting overbought levels.

Support and Resistance:

Support: Immediate support is located around 4265.24, aligning with the adaptive moving average and recent corrective lows.

Resistance: The nearest strong resistance level is positioned at 4333.60, corresponding with the Fibonacci expansion level 23.6 and previous price highs.

Conclusion and Consideration:

GOLD/USD maintains a bullish stance on the H4 chart, with price action, adaptive moving average, RSI, and William’s %R collectively signaling the potential continuation of bullish momentum. Traders should monitor upcoming Federal Reserve speeches closely, as hawkish comments might trigger short-term volatility and corrections. Consider placing cautious stops due to possible reactionary price movements following these fundamental events.

Disclaimer: The analysis provided for Gold/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on GoldUSD. Market conditions can change quickly, so staying informed with the latest data is essential.