Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Today’s fundamental analysis for the EUR/USD currency pair is driven by key data releases and central bank commentary for both the US Dollar and the Euro. The Eurozone’s economic sentiment is under the spotlight with the release of the highly anticipated ZEW Economic Sentiment Index for Germany and the Euro Area, which acts as a leading indicator of economic health and can inject significant market volatility into the Euro (EUR) if actual figures diverge from the consensus forecast. Simultaneously, the US Dollar (USD) is set for volatility due to a series of high-impact speeches from top Federal Reserve officials, including Fed Chair Jerome Powell and Governor Christopher Waller, whose comments on the economic outlook and future monetary policy will be intensely scrutinized by Forex traders for clues on the Fed’s path for interest rates. Traders should also note the release of the US NFIB Small Business Index, which offers insight into the underlying strength of the US economy, creating a high-risk environment for the daily analysis of the EUR/USD pair.

Price Action:

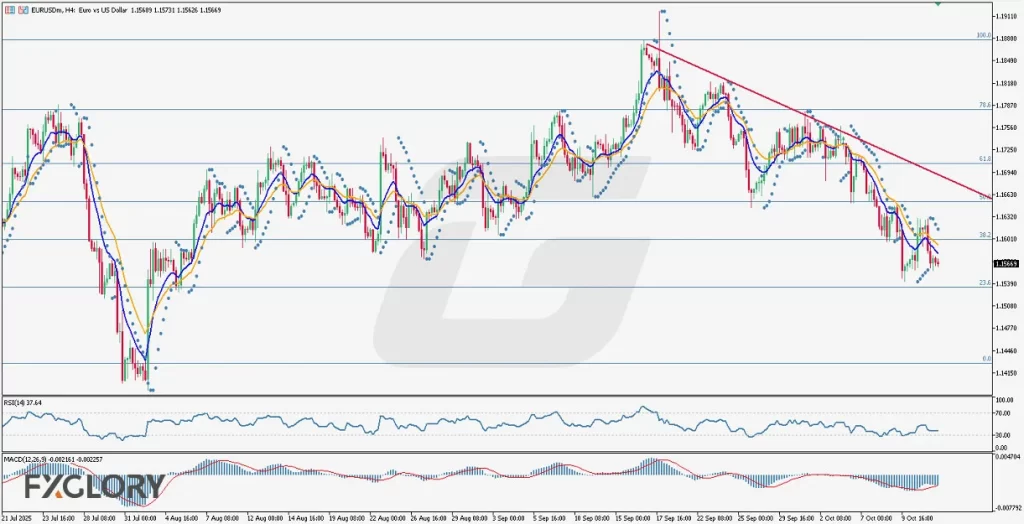

The EUR/USD price action on the H4 timeframe clearly reflects a dominant bearish trend that has been accelerating since mid-September’s high, confirming a sustained downtrend. The price is consistently printing lower highs and lower lows, remaining well below a clear descending trend line which has repeatedly acted as a dynamic resistance level. Currently, the price has failed to hold above the psychological level of 1.0600 and is testing recent lows, suggesting that the sellers are firmly in control. The overall chart structure points to strong downward momentum with very little buying interest to counter the sustained pressure, reinforcing a bearish Forex trading strategy as long as the price remains below the critical trend line resistance.

Key Technical Indicators:

Parabolic SAR: Dots are placed consistently above the candles, definitively confirming the strong bearish trend on the H4 chart and reinforcing selling pressure. Upward moves are likely corrective.

Moving Averages (MA 9 & MA 17): The short MA 9 is below the long MA 17 and they are moving downward above the candles, confirming a powerful bearish crossover and acting as a dynamic resistance zone.

RSI (Relative Strength Index 14): The RSI is at 37.64, deep in bearish territory but not yet oversold, indicating room for the price to fall. It currently supports the downtrend continuation.

MACD (Moving Average Convergence Divergence 12,26,9): The MACD line (−0.002161) is marginally above the Signal Line (−0.002257) in negative territory, suggesting a brief easing of downside momentum or consolidation, but the overall negative reading confirms dominant long-term selling pressure.

Support and Resistance:

Support: The primary support to watch for this Forex trading analysis is located at the significant psychological and long-term horizontal level of $1.05390, a break of which would open the door for a continuation toward $1.04700.

Resistance: The immediate and crucial resistance level for the EUR/USD technical chart is $1.06620, which aligns with the 38.2% Fibonacci Retracement and the descending trend line.

Conclusion and Consideration:

The comprehensive EUR/USD H4 chart forecast indicates a strongly entrenched bearish trend driven by multiple technical confirmations, including the Parabolic SAR, the bearish crossover and alignment of the MAs, and the sub-50 RSI reading. The current price action suggests a potential pause or shallow retracement, but the overall technical structure heavily favors sellers. Consideration must be given to the high-impact USD and EUR news scheduled today, particularly the ZEW data and the numerous Fed speeches, which have the potential to override technical patterns and cause abrupt volatility. Forex traders should manage risk tightly, as any hawkish comments from the Fed or unexpectedly weak ZEW figures could fuel a sharp break below the current support, validating a continued bearish EUR/USD trading strategy.

Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential.