Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/USD pair today is influenced by a series of key Eurozone and U.S. economic releases. On the Euro side, the S&P Global Manufacturing PMI and the Eurostat Consumer Price Index (CPI) reports are in focus, both critical indicators of inflation and overall economic health in the Eurozone. A stronger-than-expected PMI above 50.0 or a higher CPI reading could provide bullish momentum for the Euro, as they would reinforce expectations for ECB policy tightening. Additionally, German Bund auctions and speeches from ECB officials, such as Bundesbank President Joachim Nagel, could provide further clues about monetary policy direction. On the U.S. side, the market awaits the ADP employment report, ISM Manufacturing PMI, and speeches from Federal Reserve members, all of which may increase USD volatility and weigh on EUR USD dynamics. Traders should expect heightened volatility during these releases as both currencies face competing fundamental drivers.

Price Action:

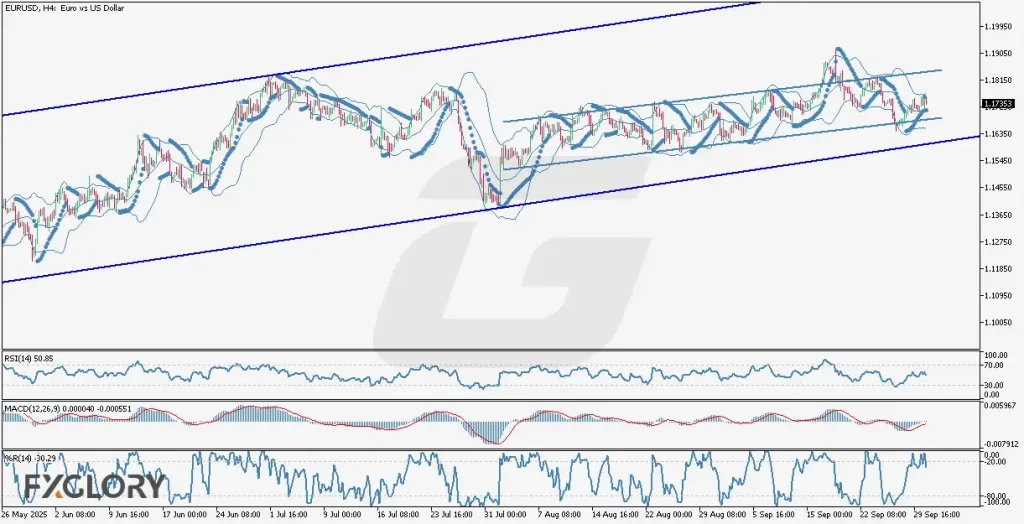

In the H4 timeframe, EURUSD is trading within a slight bullish trend channel, moving horizontally with a gradual upward slope. The pair is ranging between the upper and lower Bollinger Bands, having recently bounced from the lower band and climbed above the middle band. Currently, the candles are positioned in the upper half of the Bollinger Bands, supported by Parabolic SAR dots beneath the price, signaling a continuation of short-term bullish momentum. However, the market structure shows consolidation, and traders should monitor whether the pair can sustain momentum toward the upper channel line near resistance.

Key Technical Indicators:

Bollinger Bands: The EURUSD price is moving within a narrow bullish channel, currently in the upper half of the Bollinger Bands. The latest bullish bounce from the lower band to the upper band around 1.1780 highlights ongoing buying pressure. If the price fails to break the upper band, sideways consolidation may follow.

Parabolic SAR (Step 0.02, Max 0.2): The latest Parabolic SAR dots (steelblue) are positioned below the candles, confirming short-term bullish sentiment. As long as the dots remain beneath the price action, upward momentum is likely to continue. A reversal would be signaled only if the dots shift above the candles.

RSI (14): The RSI is at 50.85, hovering around the neutral zone. This indicates that the EUR/USD is neither overbought nor oversold, leaving room for movement in either direction. A sustained push above 60 would confirm stronger bullish momentum, while a drop below 45 could suggest renewed bearish pressure.

MACD (12,26,9): The MACD shows values at 0.000040 and -0.000551, reflecting weak momentum with the lines converging. This signals a potential shift in momentum—either a continuation of the current sideways range or the early stage of a breakout. A bullish crossover would support upside continuation.

Williams %R (14): The Williams %R is at -30.29, close to the overbought threshold. This suggests that buying pressure has been dominant in the short term, but the market may soon face resistance if momentum does not strengthen further.

Support and Resistance:

Support: The first support is at 1.1720, followed by 1.1660, and deeper support lies at 1.1600.

Resistance: The immediate resistance is at the upper Bollinger Band near 1.1780, while the next level is around 1.1820, aligned with the channel’s upper boundary.

Conclusion and Consideration:

The EUR-USD H4 chart shows the pair trading in a slight bullish trend channel, with technical indicators pointing toward mild bullish bias but with signs of consolidation. The RSI and Bollinger Bands suggest cautious optimism, while the MACD highlights weak but potentially strengthening momentum. Traders should monitor upcoming Eurozone CPI, PMI data, and U.S. employment figures, as these events may serve as catalysts for a breakout from the current consolidation range. Given the balanced technical outlook and high-impact news on both sides, EUR USD traders should prepare for potential volatility spikes.

Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential.