Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The XAG/USD price action is expected to be volatile today due to key economic events. Federal Reserve Bank of Richmond President Thomas Barkin will deliver a speech on inflation, which could provide insights into the Fed’s future monetary policy and impact the USD strength. Additionally, Federal Reserve Bank of Atlanta President Raphael Bostic will discuss the economic outlook and housing market, another factor that could influence the USD price movement. Moreover, the US New Home Sales report will be released, a key economic indicator reflecting consumer confidence. If the data beats expectations, it could further strengthen the USD, pressuring silver prices lower. Given these fundamental drivers, traders should anticipate increased volatility in the SILVERUSD price action.

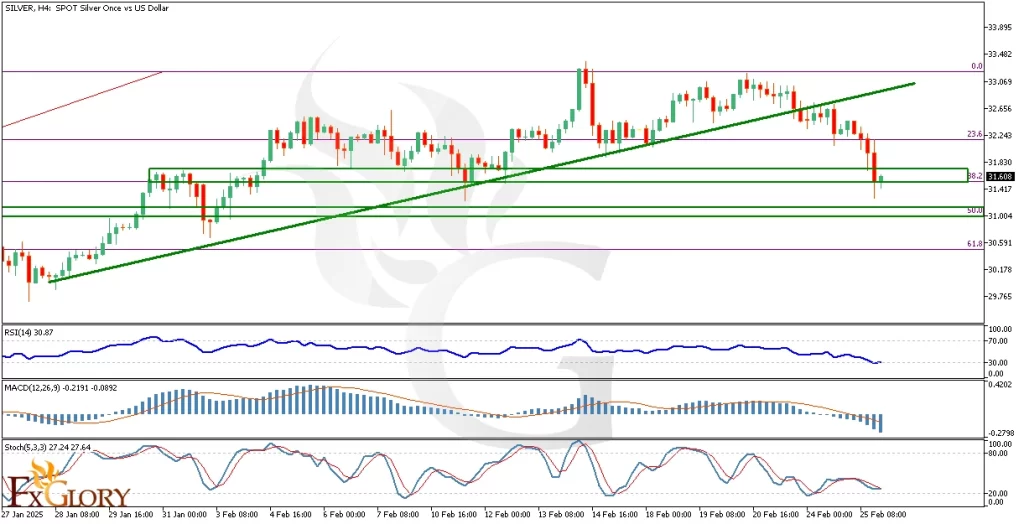

Price Action:

The SILVERUSD H4 chart indicates a bearish correction, breaking below the ascending trendline and reaching the 38.2% Fibonacci retracement level, a key support zone. The price has shown a slight reaction at this level, suggesting a possible reversal or consolidation. However, if silver fails to hold this support, the next downside target is the 50% Fibonacci retracement level, aligning with previous price consolidation areas. A sustained break below this zone could lead to a deeper correction toward the 61.8% Fibonacci retracement level, which serves as major support. On the upside, silver needs to reclaim the 23.6% Fibonacci level and the previous trendline support (now resistance) to resume its bullish trend.

Key Technical Indicators:

RSI (Relative Strength Index): The RSI on the XAG-USDH4 timeframe is currently at 30.87, indicating that silver is near oversold conditions. If RSI moves below 30, it could confirm further downside momentum, while a bounce from these levels could trigger a short-term bullish reversal.

MACD (Moving Average Convergence Divergence): The MACD histogram is in negative territory, and the MACD line remains below the signal line, confirming ongoing bearish momentum. Until we see a bullish crossover, the trend remains bearish, with the risk of further downside.

Stochastic Oscillator: The Stochastic Oscillator is currently at 27.24, signaling oversold conditions. If the indicator crosses above 30, it could indicate a buying opportunity. However, as long as it remains below this level, bearish pressure persists.

Support and Resistance:

Support: Immediate support is located at $31.60, which aligns with the 38.2% Fibonacci retracement level and a recent price consolidation area. If this level fails, the next support level is at $31.00, corresponding to the 50% Fibonacci retracement level, a key technical zone for a potential reversal. Major support is found at $30.59, aligning with the 61.8% Fibonacci retracement level, which serves as a long-term support zone.

Resistance: The nearest resistance level is at $32.24, which coincides with the 23.6% Fibonacci retracement level and the previous trendline support, now turned resistance. If silver breaks above this level, the next major resistance is located at $33.48, representing the recent swing high and a psychological resistance zone.

Conclusion and Consideration:

The XAGUSD H4 chart analysis suggests that silver is undergoing a bearish correction, testing a critical support level at the 38.2% Fibonacci retracement. The RSI and Stochastic indicators indicate oversold conditions, suggesting that a short-term rebound could occur. However, the MACD remains bearish, signaling that the downtrend is still intact. If silver fails to hold above $31.60, a further decline toward $31.00 and $30.59 is likely. Traders should closely monitor today’s Fed speeches and US economic data, as they could influence the USD strength and drive SILVERUSD price action in either direction.

Disclaimer: The analysis provided for XAG/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on XAGUSD. Market conditions can change quickly, so staying informed with the latest data is essential.