Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Today, the EURCAD pair is influenced by economic releases from both the Eurozone and Canada. The Eurozone will see the release of the German ZEW Economic Sentiment and the broader ZEW Economic Sentiment for the Eurozone, which are indicators of investor sentiment and economic expectations. A higher reading might support the Euro, signaling economic optimism in the region. For Canada, there is a significant release of inflation data, including CPI m/m, Median CPI y/y, and Core CPI m/m. With the potential for inflation to come in lower than expected (-0.7% m/m versus 0.0% forecast), this could indicate a cooling economy, possibly weakening the CAD. Traders will be looking for these economic prints to provide direction for the EURCAD pair.

Price Action:

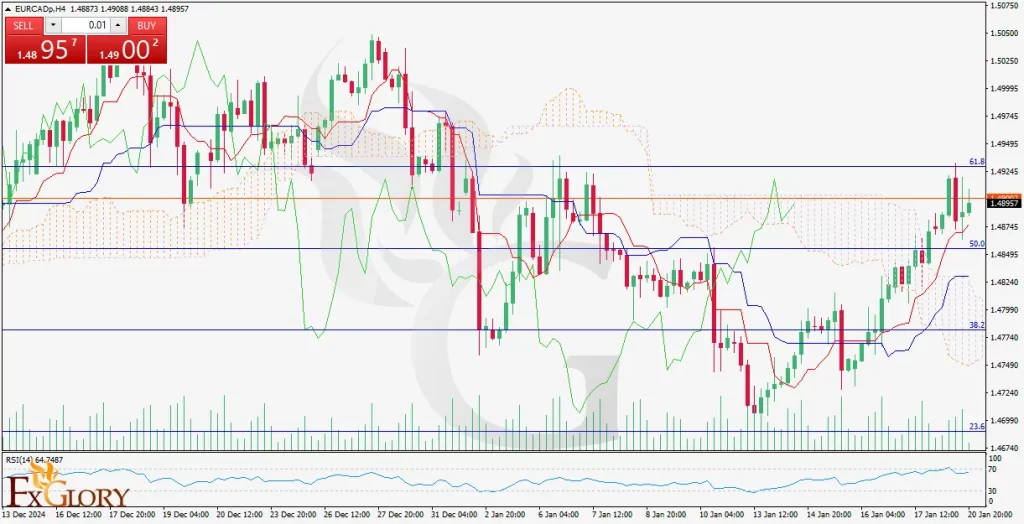

The EURCAD pair on the H4 timeframe is currently experiencing a bullish trend. The price recently broke above the Ichimoku Cloud, a key technical indicator, signaling a shift to a bullish market sentiment. As the price continues to trend higher, it has cleared key resistance levels, indicating that the buyers are in control. A possible continuation of this upward movement is expected, given that the RSI remains below 70, indicating that the market has not yet reached overbought conditions. The recent price action shows an upward momentum, with minor retracements being bought into, suggesting a strong bullish bias.

Key Technical Indicators:

Ichimoku Cloud: The price has recently broken above the Ichimoku Cloud, signaling a bullish market condition. The Chikou Span is above the price, and the Tenkan-Sen and Kijun-Sen lines are both pointing upwards, reinforcing the positive outlook.

RSI (Relative Strength Index): The RSI is currently at 64.74, comfortably below the 70 overbought threshold. This suggests there is still room for further bullish movement without entering overbought territory. As the market remains in healthy bullish conditions, the RSI confirms that the momentum is still positive and that a continuation of the trend is likely.

Support and Resistance Levels:

Support: The lower points of the recent candles around 1.48677 and 1.48555 serve as the immediate support level.

Resistance: The most recent resistance levels around the current price locate around 1.49360 and 1.50000 (psychological level).

Conclusion and Consideration:

The technical analysis of EURCAD suggests a bullish outlook, supported by the recent break above the Ichimoku Cloud, the healthy RSI reading, and the overall upward price action. The pair is likely to continue its bullish trend as long as the price remains above the identified support levels, with potential target resistance at 1.49360 and 1.49740. However, given the upcoming economic releases today, including inflation data from Canada and sentiment indices from the Eurozone, there could be increased volatility. Traders should keep an eye on these data points, as any surprises could influence the direction of the pair in the short term.

Disclaimer: The analysis provided for EUR/CAD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURCAD. Market conditions can change quickly, so staying informed with the latest data is essential.