Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/AUD currency pair is currently influenced by key fundamental factors. Today, the Eurozone is observing a German Bank Holiday, resulting in reduced liquidity for the EUR. This typically leads to lower trading volumes and can cause the EUR to exhibit subdued volatility. Conversely, the Australian Dollar (AUD) is set to react to the release of the Monetary Policy Meeting Minutes at 12:30 AM. Traders will be closely monitoring these minutes for insights into the Reserve Bank of Australia’s (RBA) future monetary policy decisions, which could significantly impact the AUD’s strength against the EUR. The interplay between reduced EUR liquidity and potential shifts in AUD policy outlooks is expected to shape the trading dynamics of the EURAUD pair today.

Price Action:

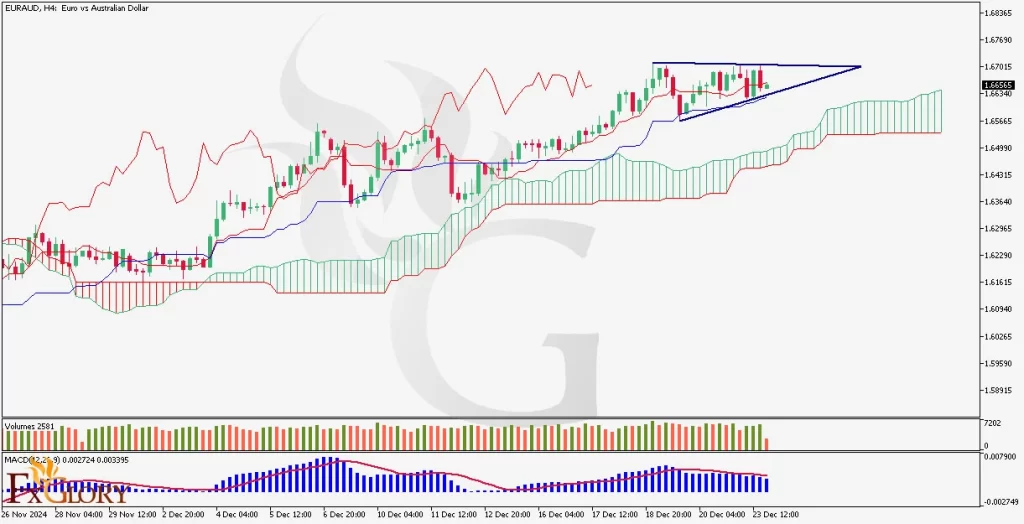

On the H4 timeframe, the EURAUD pair is demonstrating a bullish price action. The current price sits above the Ichimoku Cloud, indicating a strong upward momentum. Additionally, the price is forming a flag pattern, which suggests a continuation of the prevailing bullish trend after a brief consolidation phase. The pair has maintained its position above key support levels at 1.66172, 1.65700, and 1.65620, reinforcing the upward trajectory. This flag pattern, combined with the price being above the Ichimoku Cloud, points to a sustained bullish sentiment among traders, potentially leading to further upward movement in the near term.

Key Technical Indicators:

Ichimoku Cloud: On the EURAUD chart, the price and candles are positioned above the Ichimoku cloud, signaling a strong bullish trend. The Tenkan-sen is above the Kijun-sen, further confirming upward momentum, while the Chikou Span remains above the price action, adding additional bullish confirmation in this technical analysis.

MACD (Moving Average Convergence Divergence): The MACD line is above the signal line and both are above the zero line, indicating robust bullish momentum. The expanding MACD histogram suggests increasing strength in the upward trend, and recent bullish crossovers reinforce the potential for continued price gains.

Volume: Trading volume on the H4 timeframe for EURAUD is on the rise, supporting the bullish outlook as higher volumes accompany the upward price movement. The increasing volume during price advances indicates strong buying interest, reinforcing the likelihood of sustained bullish.

Support and Resistance Levels:

Support: Immediate support at 1.66172, where the price is currently consolidating. Further support levels are seen at 1.65700 and 1.65620, which could provide stronger buying interest if the price continues to decline.

Resistance: Resistance is located at 1.67000, a recent level where price gains were capped. Additional resistance levels are at 1.67500 and 1.68000, where stronger selling pressure may re-emerge if the price rebounds.

Conclusion and Consideration:

The EURAUD pair on the H4 chart exhibits strong bullish momentum, supported by both fundamental and technical indicators. The price remains above the Ichimoku Cloud and is forming a flag pattern, suggesting a continuation of the upward trend. RSI and volume indicators further reinforce the buy signal, while the established support levels provide a safety net against potential pullbacks. However, traders should remain cautious of upcoming fundamental events, such as the release of the AUD Monetary Policy Meeting Minutes, which could introduce volatility. Additionally, the reduced EUR liquidity due to the German Bank Holiday may lead to unexpected price movements. Overall, the technical setup is favorable for bullish traders, but staying alert to fundamental developments is essential.

Disclaimer: The analysis provided for EUR/AUD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURAUD. Market conditions can change quickly, so staying informed with the latest data is essential.