Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The USDCAD pair could experience volatility due to a mix of upcoming economic data and news from both the US and Canada. For Canada, the Wholesale Sales report might slightly impact the CAD if results are better than expected, hinting at potential consumer spending increases. On the US side, high-impact news like the Core PPI and speeches from Fed Chair Jerome Powell could significantly sway the USD. A hawkish stance from Powell or higher than forecasted PPI could strengthen the USD, affecting the pair.

Price Action:

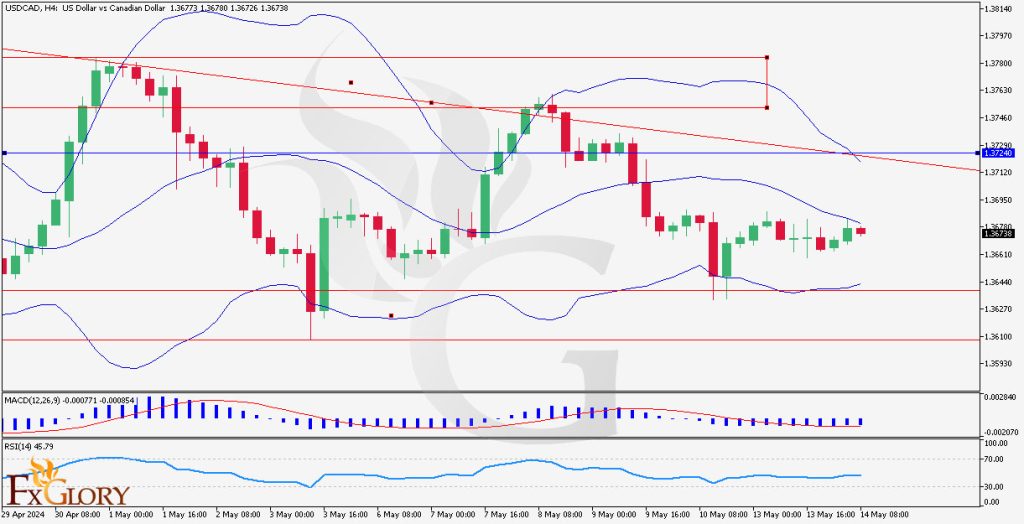

The usd/cad trend has shown a slight bearish movement in the latest candle within a generally mixed live trend over the past sessions. While there have been several green, bullish candles within the Bollinger Bands’ lower half, the most recent candle is bearish, indicating potential uncertainty or a shift in market sentiment.

Key Technical Indicators:

Bollinger Bands: The price has lingered in the lower half of the Bollinger Bands, suggesting bearish pressure, although the recent green candles indicate some buying interest.

MACD: The MACD line is below the signal line, signaling bearish momentum, although the histogram shows minimal divergence, suggesting the momentum might not be very strong.

RSI: The RSI is hovering around 45, which is slightly below neutral, indicating a bearish bias but no extreme oversold conditions that might suggest an imminent reversal.

Support and Resistance Levels:

Support: The lowest points of the recent candles around 1.3630 serve as the immediate support level.

Resistance: The upper line of the Bollinger Band and recent peaks around 1.3720 act as resistance levels.

Conclusion and Consideration:

Given the current technical setup and upcoming fundamental events, traders should monitor the USDCAD daily chart closely. The bearish signals from MACD and the position within the Bollinger Bands suggest potential further downside, but upcoming economic reports could drive volatility and directional changes. Risk management and staying updated on the economic news are advisable for trading in such conditions.

Disclaimer: The provided technical and fundamental analysis and insight is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.