Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The NZD/USD pair faces significant volatility today due to key economic data releases from both New Zealand and the United States. New Zealand’s Overseas Merchandise Trade report is set to impact the NZD, as a higher-than-forecast export surplus would positively affect the currency by indicating strong external demand. Additionally, ANZ’s Business Confidence Index release could trigger further volatility; a reading above zero would signal economic optimism, supporting the Kiwi. On the US side, traders will closely monitor initial jobless claims, productivity data, and labor costs, where better-than-expected figures could strengthen the USD by reflecting economic resilience.

Price Action:

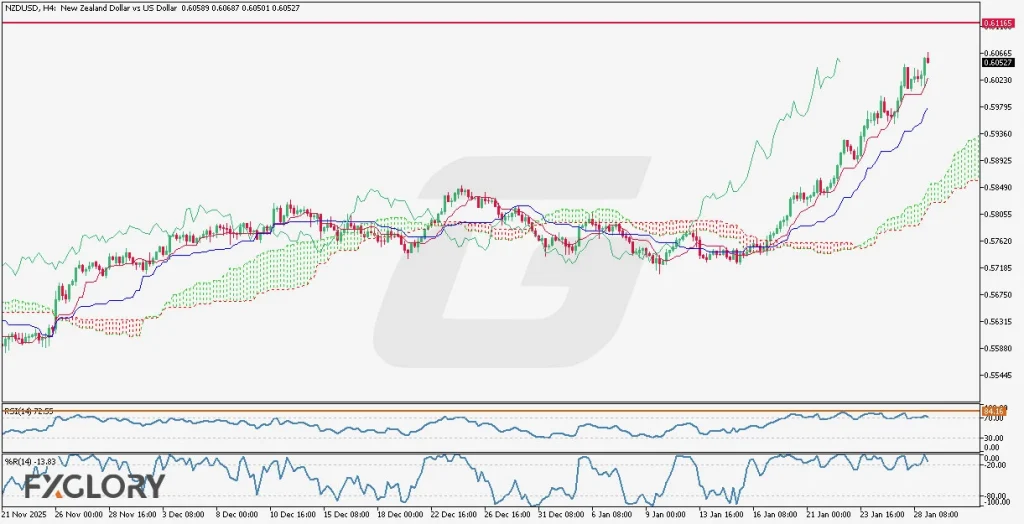

Analyzing NZDUSD price action on the H4 timeframe reveals a notable bullish reversal despite its previous long-term bearish trajectory. Recently, the candles have embarked on a robust upward trend with only minor corrective movements observed. This bullish momentum, if sustained, could soon test the historically significant resistance level at 0.61165. However, traders should exercise caution due to emerging negative divergence signals that indicate a potential reversal could be imminent.

Key Technical Indicators:

Ichimoku Cloud: The Ichimoku indicator displays a bullish outlook with price clearly above the cloud at levels 0.60589, 0.60687, 0.60501, and 0.60527, indicating strong upward momentum. However, traders should remain alert to any narrowing of the cloud, which could signal potential weakening of the bullish trend.

RSI (14): The Relative Strength Index currently stands at 72.55, placing the NZDUSD pair within the overbought territory. Although this indicates strong bullish momentum, traders should be cautious of possible corrective pullbacks as the market corrects from overbought conditions.

Williams %R (14): At -13.83, William’s %R also highlights overbought conditions, reinforcing the notion of a strong bullish momentum but simultaneously warning of potential short-term retracements or consolidations before further upward movements.

Support and Resistance:

Support: Immediate support for NZDUSD is located at 0.59850, aligned with recent consolidation zones.

Resistance: The key resistance stands firmly at 0.61165, an important historical price level.

Conclusion and Consideration:

The NZDUSD H4 technical analysis currently favors bullish continuation towards the resistance at 0.61165, supported by key indicators like the Ichimoku Cloud, RSI, and Williams %R. Nonetheless, traders must pay close attention to today’s fundamental releases from New Zealand and the United States, which could significantly influence market direction and volatility. Caution is advised due to technical indications of overbought conditions, suggesting potential short-term retracements.

Disclaimer: The analysis provided for NZD/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on NZDUSD. Market conditions can change quickly, so staying informed with the latest data is essential.