Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Fundamental Analysis: The EUR-JPY currency pair represents the valuation between the Euro (EUR) and the Japanese Yen (JPY). Today, Eurozone data highlights include the release of key inflation indicators (CPI and Core CPI) by Eurostat, potentially causing significant volatility in EUR pairs. Traders will closely monitor remarks from Deutsche Bundesbank President Joachim Nagel for insights on future ECB monetary policy directions. Concurrently, JPY traders await updates on the Bank of Japan’s monetary base and the Japanese Government Bond auction, essential indicators that may impact the Yen significantly.

Price Action:

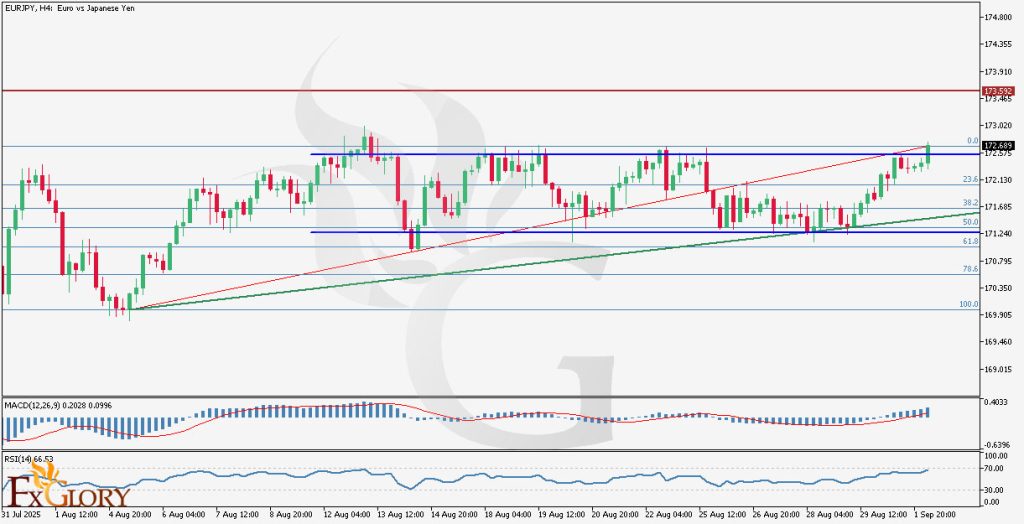

The EUR/JPY H4 chart illustrates a clear bullish momentum, recently breaking above a horizontal consolidation channel. Despite the consistent bullish price action, traders should prepare for potential corrective moves towards Fibonacci retracement levels of 23.6%, 38.2%, or even 50.0%. Immediate bullish targets are set around the previous high at 172.826 or the subsequent resistance at 173.592. Traders are advised to confirm a sustained breakout for further bullish continuation.

Key Technical Indicators:

MACD (Moving Average Convergence Divergence): The MACD indicator shows bullish momentum, with a signal line currently at 0.0996 and the histogram positively positioned at 0.2028. This indicates ongoing buyer dominance but suggests vigilance for signs of momentum exhaustion or reversal signals.

RSI (Relative Strength Index): The RSI level is currently at 66.53, approaching the overbought threshold. Although bullish momentum persists, RSI readings near overbought conditions highlight the possibility of a short-term retracement or consolidation phase.

Support and Resistance:

Support: Immediate support levels lie at Fibonacci retracement levels, notably at 172.130 (23.6%) and further down at 171.685 (38.2%).

Resistance: Primary resistance targets include the recent high at 172.826 and the more significant resistance level at 173.592.

Conclusion and Consideration:

The EURJPY pair maintains bullish momentum on the H4 timeframe, supported by favorable MACD and RSI indications. However, price actions near resistance zones and potential overbought signals suggest caution. Upcoming economic news from both the Eurozone and Japan could introduce substantial volatility, emphasizing the importance of risk management and close monitoring of key technical levels.

Disclaimer: The analysis provided for EUR/JPY is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURJPY. Market conditions can change quickly, so staying informed with the latest data is essential.