Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Today, EUR-USD traders will closely monitor critical economic indicators from both the US and Eurozone. From the US side, traders will watch the release of the GDP Second Release, which significantly influences market sentiment and USD volatility. Concurrently, initial jobless claims will also garner attention, offering insights into the labor market’s health, directly impacting USD strength. For EUR, data regarding new private sector loans and money supply from the European Central Bank (ECB) could potentially increase volatility, as these indicators reflect economic growth and inflation pressures. Traders should exercise caution, as unexpected figures could drive sharp EURUSD fluctuations.

Price Action:

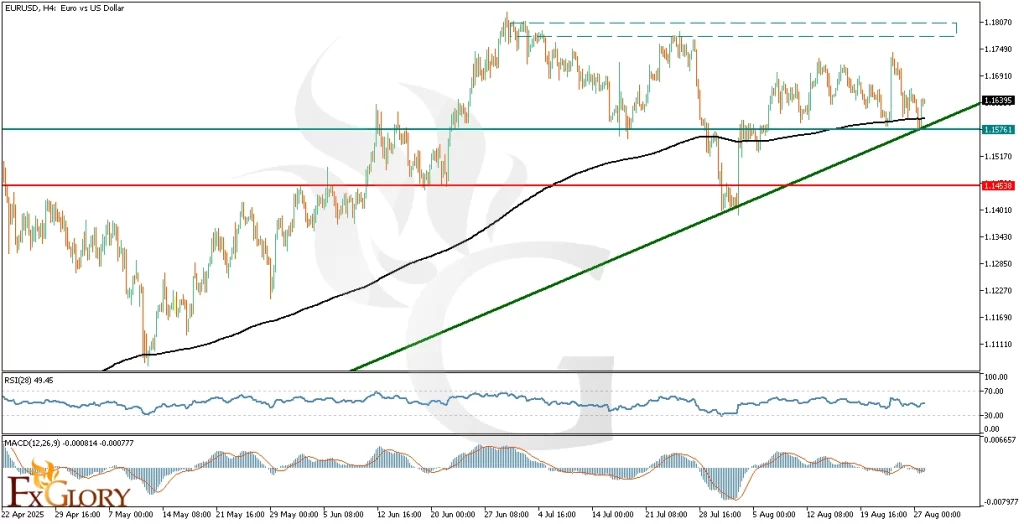

EUR/USD analysis on the H4 timeframe confirms a bullish trend, evidenced by price action consistently respecting an ascending support line. The current price level coincides with the EMA (300), presenting a strong confluence support zone around 1.15761. Historical price action reveals that when such a convergence occurred previously, the price embarked on a strong upward movement. Traders should observe candlestick formations at this critical support level for confirmation of a potential bullish continuation targeting previous highs.

Key Technical Indicators:

EMA (300): EUR/USD price currently tests the dynamic support provided by the EMA (300). Historically, this moving average has acted as a strong trend-following support, indicating that bullish momentum might resume if price successfully remains above this line.

RSI (28): The RSI indicator at 49.45 suggests a neutral market stance, reflecting balanced buying and selling pressures. The indicator remains far from overbought or oversold zones, indicating potential for movement in either direction based on upcoming fundamental catalysts.

MACD (12,26,9): The MACD histogram currently shows diminishing bearish momentum, with the MACD line converging closely with the signal line. Traders should monitor closely for a bullish crossover, which would indicate the renewal of buying momentum and validate a bullish scenario.

Support and Resistance:

Support: Immediate and strong support lies at 1.15761, further reinforced by the EMA (300) and ascending trendline convergence.

Resistance: Immediate resistance is identified around recent highs at 1.16395, while more substantial resistance lies near the upper horizontal levels at approximately 1.17800.

Conclusion and Consideration:

EUR-USD’s technical and fundamental H4 analysis favors a bullish continuation scenario, driven by strong technical confluences and potentially supportive fundamental news. Traders should closely watch today’s US GDP Second Release, Initial Jobless Claims, and ECB economic releases to guide their short-term trading decisions. Strategic entry points at confirmed bullish signals near the current support could target previous resistance zones. However, prudent risk management practices and cautious positioning ahead of significant economic news releases are strongly recommended.

Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential.