Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/CHF pair represents the exchange rate between the Euro (EUR) and the Swiss Franc (CHF). Today, liquidity in EUR could be lower due to French banks observing the National Day holiday, typically resulting in irregular volatility. Meanwhile, the upcoming release from the Eurogroup meeting could significantly impact EUR movements depending on their policy stance and economic decisions. For CHF, traders are awaiting the Producer Price Index (PPI) from the Federal Statistical Office, a critical indicator influencing consumer inflation expectations and consequently CHF strength.

Price Action:

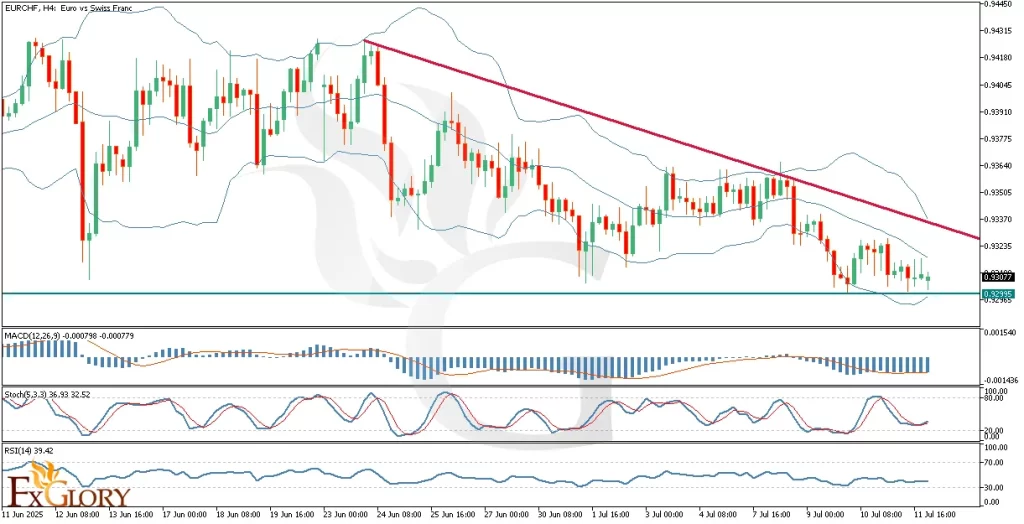

Analyzing the EUR-CHF pair on the H4 timeframe reveals a persistent bearish trend originating from around 2021. The price has recently approached the strong support zone around 0.92300, coinciding closely with the lower boundary of the Bollinger Bands, highlighting a Price Reversal Zone (PRZ). However, recent bearish momentum seems robust, indicating the current bullish attempts might merely be corrections, and a retest of the 0.92300 support level could be imminent.

Key Technical Indicators:

Bollinger Bands: The Bollinger Bands are indicating a tight range at the bottom band near the 0.92300 support level, suggesting potential for a reversal or consolidation. Nevertheless, the recent price action’s proximity to the lower band emphasizes ongoing bearish pressure, cautioning traders about potential downward continuation.

MACD (Moving Average Convergence Divergence): MACD shows a slight bullish crossover, reflected by the MACD line marginally above the signal line, yet the histogram remains negative. This signals that while there might be a temporary correction upward, the overall bearish momentum remains dominant.

Stochastic Oscillator: The Stochastic oscillator, currently positioned around 36.93, shows mixed signals with no clear indication of overbought or oversold conditions. Its mid-range position suggests that the market is indecisive at this moment, signaling cautious trading.

RSI (Relative Strength Index): RSI stands at 39.42, firmly in bearish territory below 50, indicating continued bearish sentiment. The RSI highlights the potential for further downward moves before approaching oversold levels.

Support and Resistance:

Support: Immediate and critical support level is at 0.92300, closely aligned with the current PRZ and the Bollinger Bands’ lower line.

Resistance: The significant resistance is located around the descending trendline near 0.93300, serving as a key barrier to any bullish correction.

Conclusion and Consideration:

EUR CHF’s H4 chart shows a continuation of bearish momentum despite potential correction efforts. Technical indicators support sustained bearish sentiment, though temporary upward corrections are possible due to the proximity of the support zone and Bollinger Bands. Fundamental developments from today’s EUR and CHF news could significantly influence the pair, especially given expected irregular volatility due to the French bank holiday and the forthcoming PPI release from Switzerland.

Disclaimer: The analysis provided for EUR/CHF is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURCHF. Market conditions can change quickly, so staying informed with the latest data is essential.