Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Today, the GBPUSD pair is poised for a potentially volatile session as both UK and US economic releases influence market sentiment. Early UK data reveals a mixed picture: GDP m/m unexpectedly contracted by 0.1% versus the forecasted 0.2%, while Industrial and Manufacturing Production both declined by 0.4% and 0.8% respectively, indicating softness in the UK’s economic activity. Construction Output came in slightly below expectations at 0.3%, and the Goods Trade Balance widened to -£20.8B, missing the -£19.9B estimate. However, the Index of Services held steady at 0.7%, offering some stability. On the US side, inflation readings were generally in line or slightly stronger, with Core CPI m/m rising 0.3% (vs. 0.2%) and CPI y/y at 2.5% (vs. 2.3%), reinforcing the case for a cautious Fed. Additionally, Core PPI and PPI m/m both rebounded into positive territory, while Unemployment Claims fell to 242K, better than expected. With inflation pressures persisting in the US and economic signals from the UK turning softer, GBPUSD may face downside pressure, though traders will remain alert to upcoming Fed commentary and broader risk sentiment.

Price Action:

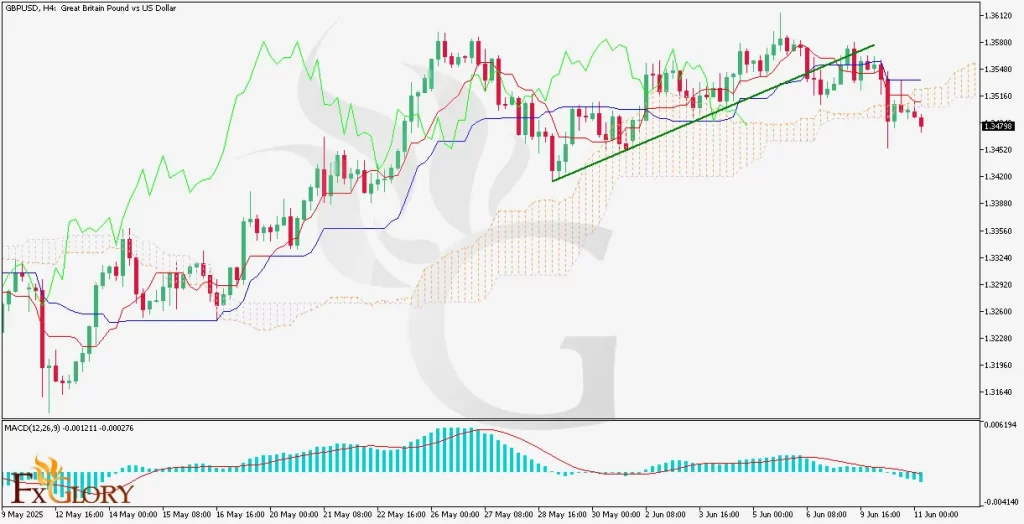

GBP/USD price action analysis on the H4 timeframe signals a potential shift toward bearish momentum following a break below key technical levels. The pair has decisively fallen beneath both its recent ascending trendline and the Ichimoku Cloud, indicating a weakening bullish structure. The cloud itself has turned bearish, with future cloud projection showing a downward tilt. Price is also trading below both the Tenkan-Sen (red line) and Kijun-Sen (blue line), reinforcing the bearish bias. Meanwhile, the MACD histogram has dipped into negative territory with increasing downside bars, suggesting growing bearish momentum and a possible continuation of the downward wave. If the pair sustains below the 1.3470 area, further declines could target support zones near 1.3400 and possibly extend toward 1.3340 in the near term.

Key Technical Indicators:

Ichimoku Cloud: The Ichimoku Cloud on the GBP/USD H4 chart shows a bearish configuration. The price has broken decisively below the cloud, signaling a shift from bullish to bearish sentiment. Both the Tenkan-Sen (red line) and Kijun-Sen (blue line) are above the current price, reinforcing downward pressure. The cloud ahead is bearish and slightly expanding, indicating growing downside momentum and a potential continuation of the bearish trend.

MACD (Moving Average Convergence Divergence): The MACD histogram has turned negative with increasing red bars, suggesting strengthening bearish momentum. The MACD line is below the signal line and diverging further, confirming the bearish crossover and trend continuation potential. This setup supports a downside bias for GBP/USD in the near term.

Support and Resistance:

Support: Immediate support for GBP/USD is seen near the 1.3420 level, which has previously acted as a consolidation base. A break below this could open the door to further downside targets around 1.3360, with a crucial support zone lying near 1.3320.

Resistance: On the upside, initial resistance is located around 1.3515, marked by the flat Kijun-Sen and previous price congestion. If bulls reclaim this level, the next key resistance is near 1.3580, aligning with the recent swing high before the breakdown.

Conclusion and Consideration:

In summary, GBP/USD appears vulnerable to further downside in the near term, driven by a combination of weaker-than-expected UK economic data and firmer US inflation metrics that support a cautious but hawkish Fed outlook. From a technical standpoint, the pair has broken below critical support levels, with bearish signals confirmed by the Ichimoku Cloud and MACD indicators. As price action remains under pressure and below key moving averages, momentum favors sellers, especially if the 1.3420 level fails to hold. Traders should closely monitor upcoming Fed commentary and broader market sentiment, as any shift in risk appetite or central bank tone could influence short-term direction.

Disclaimer: The analysis provided for GBP/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on GBPUSD. Market conditions can change quickly, so staying informed with the latest data is essential.