Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/USD currency pair is highly influenced by the economic conditions in both the Eurozone and the United States. The Euro is currently affected by upcoming economic data releases, with the Industrial Output report from Istat scheduled for release on July 10, 2025. A positive result could indicate a stronger euro, boosting market sentiment for EUR. On the US side, the NFIB Small Business Index report is due on July 8, 2025, which could give further insight into the health of the US economy. Traders will closely watch these data points for any signs of strengthening or weakening in the respective currencies.

Price Action:

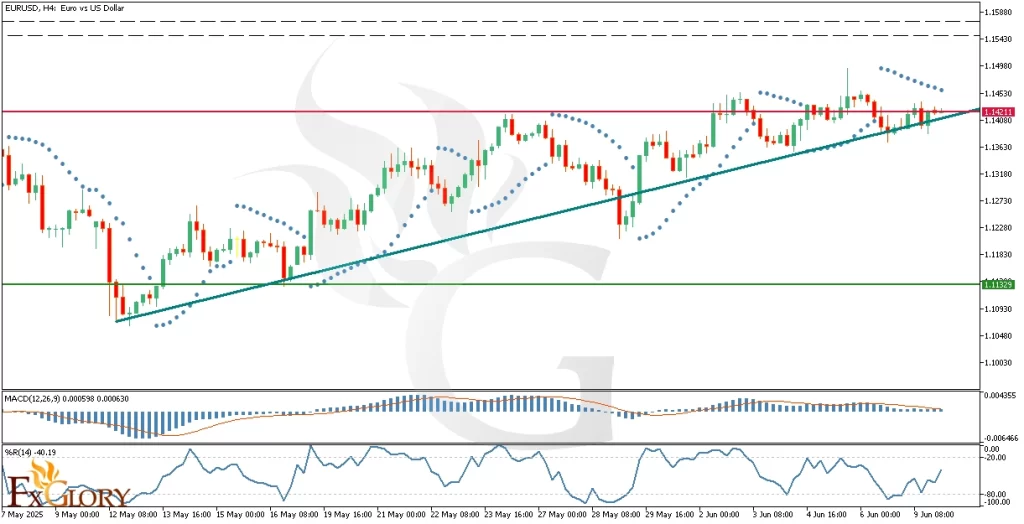

The EUR-USD is currently experiencing a strong upward movement, following a pullback to the broken support level at 1.11330. This breakout has pushed the price towards its resistance zone near 1.1420, showing that the bullish momentum is intact. The price action is forming an ascending triangle pattern, indicating that a potential breakout above this resistance level could drive the price higher, potentially targeting the last high at around 1.15640. Traders should watch for the breakout confirmation to seize the next move.

Key Technical Indicators:

Parabolic SAR: The Parabolic SAR is currently positioned below the price, confirming the bullish trend. The consistent dots beneath the price suggest that the upward momentum could continue, with the SAR providing support at lower levels if the price retraces.

MACD (Moving Average Convergence Divergence): The MACD is showing bullish momentum with the MACD line above the signal line, and the histogram remains positive. However, the momentum is starting to show signs of slowing down, as indicated by the decreasing size of the histogram. Traders should remain cautious for a possible slowdown in the bullish trend.

%R (Williams %R): The %R indicator is currently positioned in the neutral zone, showing a value of around -40.19. This suggests that the market is neither overbought nor oversold, which aligns with the ongoing bullish price action without signaling any immediate reversal or exhaustion.

Support and Resistance:

Support: Immediate support is located at 1.11330, which aligns with the broken level that previously acted as a strong support. If the price retraces, this level could offer substantial support and lead to further upward movement.

Resistance: The nearest resistance level is at 1.1420, where the price has recently encountered a strong barrier. A break above this level could signal a continuation of the bullish trend, targeting higher levels.

Conclusion and Consideration:

The EURUSD pair is in a strong uptrend, supported by a solid break above the 1.11330 level. The Parabolic SAR and MACD indicators back the bullish move, but traders should watch for any signs of weakening momentum in the MACD histogram. The price action suggests that the pair is in the process of testing resistance at 1.1420, and a breakout above this level could lead to a test of 1.15640. Economic data from both the Eurozone and the US in the coming weeks will be crucial in shaping the direction of the EURUSD. Traders should stay vigilant for any shifts in sentiment and be prepared for potential volatility.

Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential.