Time Zone: GMT +3

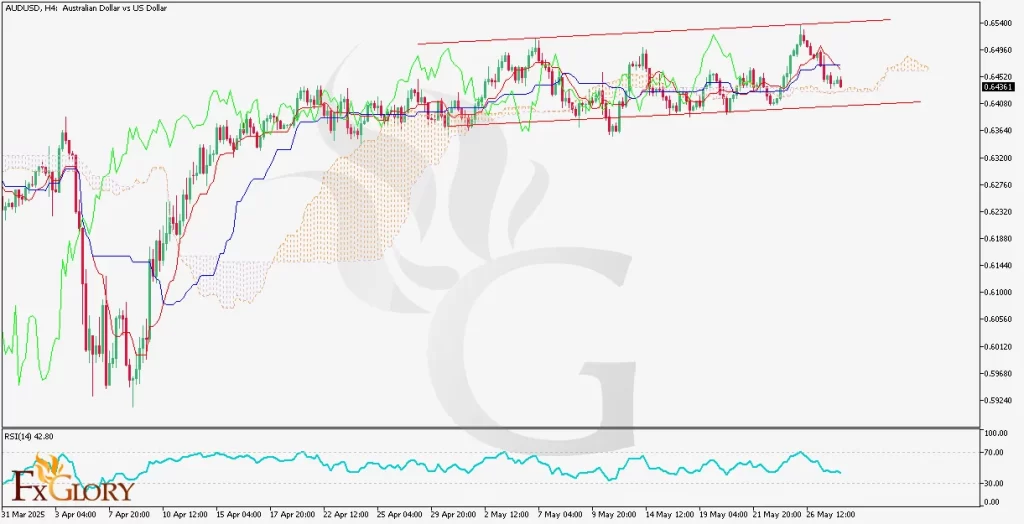

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Today’s fundamental landscape is shaped by key economic releases and central bank developments influencing both the AUD and USD. For the Australian Dollar, focus is on the year-over-year Consumer Price Index (CPI), which came in at 2.3%, slightly below the forecast of 2.4%, potentially softening inflation expectations and reducing pressure on the RBA to tighten policy further. Construction Work Done matched expectations at 0.5% q/q, offering little surprise to the market. On the USD side, traders are eyeing several important events, including the Richmond Manufacturing Index, which printed at -9 versus the prior -13, indicating slight improvement but still signaling contraction. The release of the FOMC Meeting Minutes later in the day will be closely scrutinized for any hawkish tilt, while the API Weekly Statistical Bulletin could impact market sentiment, especially in energy-related sectors. Stronger-than-expected signals from the Fed could provide support for the U.S. Dollar.

Price Action:

The AUD-USD pair on the H4 timeframe is currently consolidating within a rising channel, bounded by clearly defined red trendlines. Price action shows a recent rejection near the upper boundary, followed by a retreat toward the midline of the Ichimoku cloud, which is now acting as potential dynamic support. The RSI is hovering around 42.80, indicating mild bearish momentum but not yet oversold. Notably, the price remains above the long-term ascending trendline, suggesting the broader bullish structure is intact. A decisive move below the Ichimoku cloud and channel support could signal a bearish reversal, while a bounce from this level may open the path for another test of the upper resistance line.

Key Technical Indicators:

Ichimoku Cloud: Price is testing the top of the cloud after falling below the Tenkan-sen and Kijun-sen, signaling short-term bearish pressure. A break below the cloud could confirm a bearish shift, while a bounce may revive bullish momentum.

RSI: RSI sits at 42.80, showing mild bearish momentum but not oversold. A rebound from this level could hint at a potential bullish reversal if supported by price action

Support and Resistance:

Support: The first key support is located at approximately 0.64080, near the ascending channel’s lower boundary. A deeper support level lies around 0.63650, which has previously acted as a price floor.

Resistance: Immediate resistance is seen at approximately 0.64950, near recent highs. A higher resistance level is positioned around 0.65400, marking the upper boundary of the rising channel.

Conclusion and Consideration:

The AUD-USD pair remains at a critical juncture, with price action consolidating within a rising channel and key support levels being tested. While fundamentals suggest mixed sentiment—soft Australian inflation data versus potentially hawkish U.S. signals—the technical outlook remains cautiously bullish as long as the price holds above 0.64080. Traders should closely monitor the reaction to upcoming U.S. events and watch for a decisive move either below the Ichimoku cloud for a bearish confirmation or a rebound toward resistance levels for a continuation of the upward trend.

Disclaimer: The analysis provided for AUD /USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on AUDUSD. Market conditions can change quickly, so staying informed with the latest data is essential.