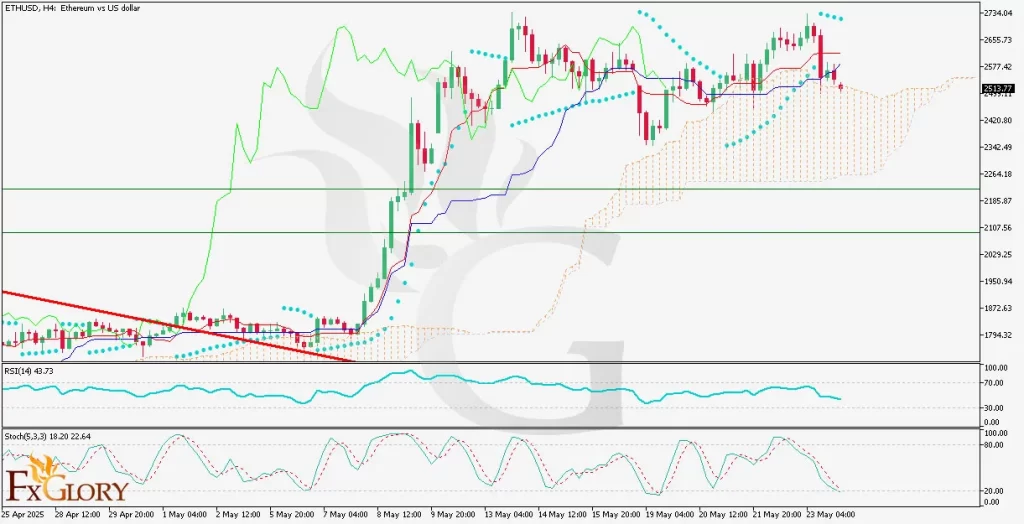

Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Today, the ETHUSD pair could experience lower liquidity and irregular volatility due to the US banks being closed for Memorial Day. Historically, when banks are closed, the market becomes less liquid, and speculative activities tend to increase, causing potential abnormal volatility levels. Ethereum’s fundamental outlook remains dependent on general crypto market sentiment and developments, including regulatory announcements and technological updates on the Ethereum blockchain.

Price Action:

ETH-USD price action on the H4 timeframe recently broke a significant downtrend line, signaling a transition from bearish to bullish sentiment. After this breakout, ETHUSD exhibited a bullish rally followed by a correction phase, currently testing the Ichimoku cloud region. The pullback towards a previously broken level indicates potential support around that area, setting the stage for another bullish leg if buyers step back in.

Key Technical Indicators:

Ichimoku Cloud: ETH USD is testing the upper boundary of the Ichimoku Cloud, indicating a critical juncture. A clear rebound off this area would validate bullish strength, while breaking deeper into the cloud could hint at bearish momentum returning.

Parabolic SAR: The indicator has recently shifted above the candlesticks, suggesting current short-term bearish pressure. Traders should await a reversal below the candlesticks to confirm a resumption of bullish momentum.

RSI (Relative Strength Index): The RSI is currently at 43.73, highlighting neutral market conditions with no immediate indication of overbought or oversold status. This provides room for price movement in either direction.

Stochastic Oscillator: The Stochastic is in oversold territory (18.20, 22.64), suggesting potential upward movement soon. Traders should watch for a bullish crossover as a confirmation signal for entering long positions.

Support and Resistance:

Support: Immediate support is at 2420, aligning with the Ichimoku cloud’s upper boundary and previous structural support. The next significant support is around 2260.

Resistance: Immediate resistance is located at 2655, with a stronger resistance level noted at the recent high of 2734.

Conclusion and Consideration:

ETH/USD H4 analysis indicates the potential continuation of bullish momentum following the recent correction to the previously broken resistance (now support). However, traders must monitor price behavior closely within the Ichimoku cloud. Given today’s US bank holiday, irregular volatility and low liquidity could affect market conditions, making it essential to maintain tight risk management.

Disclaimer: The analysis provided for ETH/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on ETHUSD. Market conditions can change quickly, so staying informed with the latest data is essential.