Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

XAUUSD (Gold vs. US Dollar) traders are closely monitoring today’s key economic events impacting the USD. The upcoming speech by Federal Reserve Bank of Chicago President Austan Goolsbee may provide crucial insights into future monetary policy. Hawkish statements may strengthen the USD, potentially putting pressure on Gold prices. Additionally, the release of the Conference Board’s Leading Indicators Index will give investors further clarity on the US economy’s trajectory, possibly affecting USD strength and subsequently influencing Gold market sentiment. Moreover, IMF meetings discussing global economic stability, monetary policy, and geopolitical risks could significantly impact market volatility for XAU/USD.

Price Action:

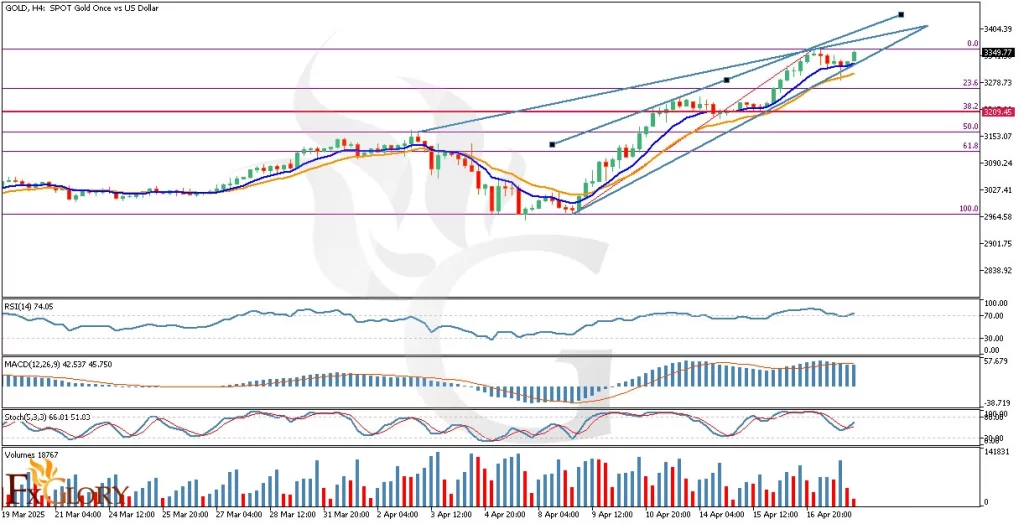

XAU-USD on the H4 chart demonstrates a clear bullish trend, steadily approaching its previous all-time high (ATH). The price action shows consistent upward movement with minor corrective pullbacks, confirming the resilience of the bullish momentum. Currently, the price is nearing the Fibonacci 0 level, indicating strong bullish sentiment. The short-term Moving Average (MA 9, blue) has crossed above the longer-term Moving Average (MA 17, orange), signaling bullish continuation potential.

Key Technical Indicators:

Moving Averages (MA): On the H4 timeframe, the short-term MA (9-period, blue) has decisively crossed above the long-term MA (17-period, orange), confirming bullish momentum. This bullish crossover is typically viewed as a strong positive signal by traders, indicating the potential for further upward price movements.

RSI (Relative Strength Index): The RSI currently stands at 74.05, signaling strong bullish momentum and slightly overbought conditions. This implies that although bullish sentiment dominates, traders should remain cautious of potential corrective pullbacks due to overbought conditions.

MACD (Moving Average Convergence Divergence): The MACD indicator remains positive, with the MACD line clearly above the signal line, highlighting strong upward momentum. The histogram also supports ongoing bullish strength but traders should monitor for decreasing momentum as the price approaches resistance levels.

Stochastic Oscillator: The stochastic oscillator is positioned at 66.01, exhibiting upward momentum without being excessively overbought. This suggests room for further bullish advancement but advises caution as the indicator approaches higher threshold values.

Volume: Trading volumes have been stable, supporting the recent bullish price movements. Consistent volumes confirm sustained market interest, adding reliability to the ongoing bullish trend for XAUUSD.

Support and Resistance

Support: Immediate support lies around the 3278.73 level (Fibonacci 23.6%), aligning with recent consolidation zones.

Resistance: Critical resistance is the current ATH around the 3340.39 mark, where significant selling pressure may appear.

Conclusion and Consideration

The XAUUSD/GOLDUSD H4 analysis suggests bullish market conditions remain intact, reinforced by bullish MA crossover, strong RSI, MACD positivity, and supportive volumes. However, traders should closely watch key economic events today, including the Fed speech, Leading Indicators release, and IMF meetings, which could create considerable market volatility. Due to RSI’s overbought conditions, traders are recommended to consider prudent risk management strategies for potential short-term pullbacks around the resistance levels.

Disclaimer: The analysis provided for XAU/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on XAUUSD. Market conditions can change quickly, so staying informed with the latest data is essential.