Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Today, EURGBP traders should closely monitor economic releases from both the Eurozone and the United Kingdom. The Eurozone is releasing the Import Price Index, Real Retail Sales, and CPI data from Germany and Italy, significant indicators affecting inflation and consumer spending. Stronger-than-forecast figures typically enhance the Euro’s strength, reflecting economic resilience. Concurrently, GBP traders should watch closely the Bank of England’s data on Money Supply, Mortgage Approvals, and Consumer Credit, which influence economic growth and consumer confidence. Higher-than-expected results generally support GBP strength.

Price Action:

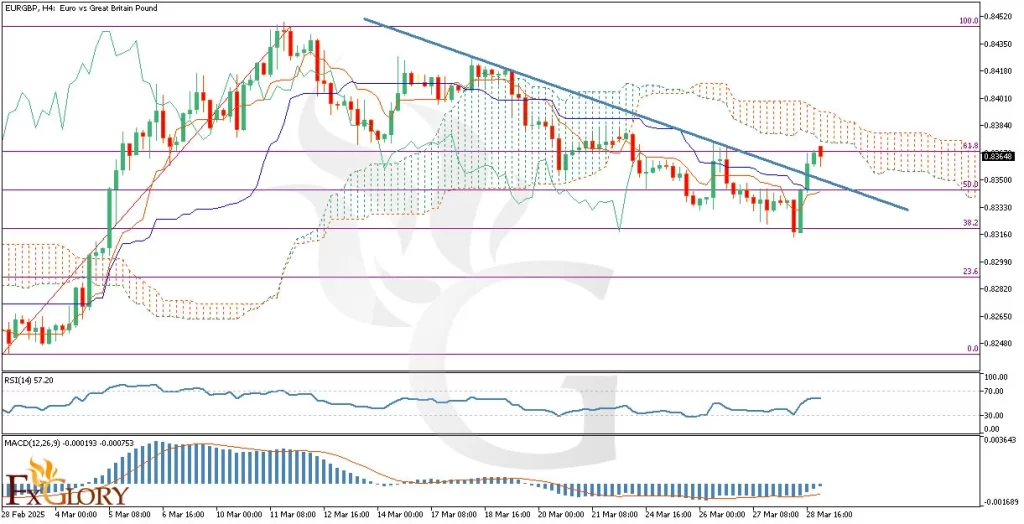

The EUR-GBP H4 timeframe analysis demonstrates a prevailing bearish trend, although recent candles indicate bullish corrective momentum moving upward towards the Ichimoku Cloud. After four consecutive bullish candles, the latest candle has turned bearish, reflecting a potential bearish reaction around the 61.8% Fibonacci retracement level. Traders should observe whether price action confirms a bearish reversal at this critical resistance or resumes upward momentum towards cloud penetration.

Key Technical Indicators:

Ichimoku Cloud: Currently, the EUR GBP price is approaching the cloud resistance, indicating a potential struggle between bullish correction and overall bearish sentiment. Price rejection from the cloud boundary would reinforce bearish continuation signals.

MACD (Moving Average Convergence Divergence): The MACD histogram is narrowing toward the zero line, indicating reduced bearish momentum and potential for bullish pressure. However, as it remains negative, bearish sentiment is still technically intact.

RSI (Relative Strength Index): RSI stands at 57.20, indicating neutral-to-bullish momentum. Given the absence of overbought or oversold conditions, the indicator suggests price still has space for potential upward movement, but caution is recommended at current resistance levels.

Support and Resistance:

Support: Immediate support is seen at the 0.8330 price level, aligning with recent lows and the 38.2% Fibonacci retracement.

Resistance: The current resistance stands at approximately 0.8370, corresponding with the 61.8% Fibonacci level and Ichimoku Cloud bottom.

Conclusion and Consideration:

The EUR/GBP H4 technical and fundamental analysis indicates a critical decision point, as the pair tests key resistance at the 61.8% Fibonacci level and Ichimoku Cloud. The short-term bullish correction could lose momentum if resistance holds firm. Traders should closely monitor upcoming economic data releases, which could substantially influence market volatility and directional bias. A clear breakout or rejection at current levels will provide better entry signals.

Disclaimer: The analysis provided for EUR/GBP is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURGBP. Market conditions can change quickly, so staying informed with the latest data is essential.