Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Today, the USD-CAD currency pair is likely to experience increased volatility due to important economic announcements from both the US and Canada. From the US side, traders will focus closely on Federal Reserve members Thomas Barkin, Michael Barr, and Raphael Bostic’s speeches, which may provide insights into future monetary policy direction, influencing the USD significantly. Moreover, the release of key economic data such as Personal Consumption Expenditures (PCE), Disposable Personal Income, Consumer Spending, and the University of Michigan Consumer Sentiment Index will play a critical role in gauging inflation and economic health. From Canada, GDP data from Statistics Canada will also be crucial, potentially impacting the CAD substantially as it reflects overall economic activity.

Price Action:

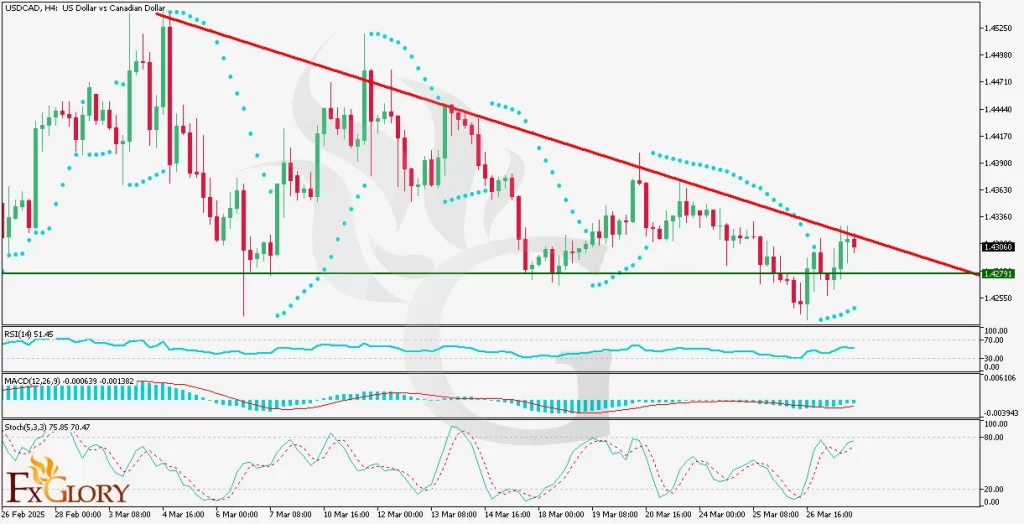

The USD/CAD price action in the H4 timeframe indicates the pair is currently trapped within a classic triangle pattern. Recently, the price has approached the upper descending resistance line of this triangle and reacted to it, creating bearish pressure at the resistance. This price behavior could potentially push USDCAD down towards the lower support boundary of the triangle, near the level of 1.42791. The last candle’s red color serves as confirmation of the bearish reaction, suggesting cautious trading as price could break out from either side of the triangle.

Key Technical Indicators:

Parabolic SAR: The Parabolic SAR dots for the last six candles are positioned below the current candle formation, indicating the presence of short-term bullish sentiment. However, given the recent bearish reaction from the resistance line, traders should remain cautious and await further confirmation.

RSI (Relative Strength Index): The RSI is currently at 51.45, signaling a neutral momentum as it is situated close to the mid-level (50). This indicates a market without immediate overbought or oversold conditions, thus allowing potential room for price movements in either direction based on upcoming economic data.

MACD (Moving Average Convergence Divergence): MACD shows diminishing negative histogram bars approaching the zero line, suggesting a decreasing bearish momentum. Traders should watch closely for a possible bullish crossover, which could indicate a shift towards a bullish outlook, provided the triangle resistance line is convincingly breached.

Stochastic Oscillator: The stochastic indicator currently reads around 75.85, showing proximity to overbought conditions. Given that the %K line is nearing the upper bound, it implies that there might be limited upside potential in the short term, thus supporting the case for a possible bearish pullback towards support levels.

Support and Resistance:

Support: Immediate technical support is located at the triangle’s bottom boundary around 1.42791, a significant zone where the price has previously reacted.

Resistance: The nearest resistance remains the descending trend line of the triangle pattern, currently near the 1.43060 mark, an important technical barrier for the bulls.

Conclusion and Consideration:

USD CAD H4 analysis currently suggests a cautious bearish outlook, primarily driven by the reaction at the resistance line within the triangle formation. Technical indicators display mixed signals; however, the price action strongly favors a potential short-term downside movement towards 1.42791. Traders should remain vigilant ahead of significant US and Canadian economic data and speeches today, which could lead to breakout moves from the triangle. Proper risk management and monitoring of the mentioned technical and fundamental aspects are advised.

Disclaimer: The analysis provided for USD/CAD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on USDCAD. Market conditions can change quickly, so staying informed with the latest data is essential.