Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/USD currency pair today will likely be influenced significantly by flash PMI reports for both the Eurozone and the US, released by S&P Global. Purchasing Managers’ Index (PMI) data, crucial for gauging economic health, could trigger volatility if actual figures diverge from market forecasts. Additionally, traders should watch speeches by Federal Reserve Bank of Atlanta President Raphael Bostic and Federal Reserve Governor Michael Barr, whose statements could provide insights on future monetary policy and impact the USD.

Price Action:

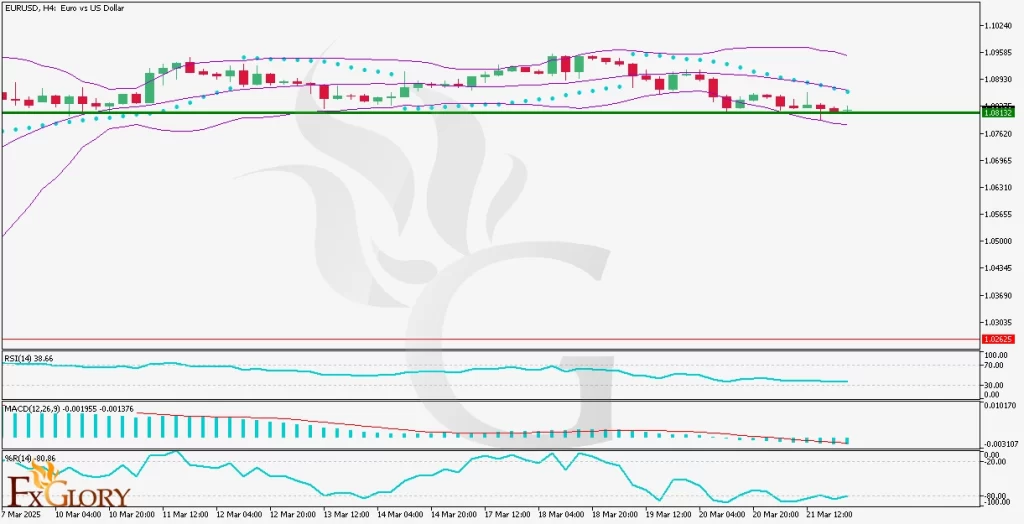

EURUSD price action analysis in the H4 timeframe indicates the price has reached a critical support level and has reacted to it positively. Several pin bar candles have formed near the support, indicating indecision and imminent volatility. A move upward towards the middle Bollinger Band, acting as the first target, followed by the upper Bollinger Band, could be expected as traders anticipate a price correction from this support level.

Key Technical Indicators:

Bollinger Bands: EURUSD’s Bollinger Bands show that the price is currently at the lower band, signaling a potential reversal upward. With the middle Bollinger Band serving as an initial target (around 1.0850), a sustained move above this level could lead towards the upper band, near 1.0900.

RSI (Relative Strength Index): The RSI indicator stands at approximately 38.66, slightly above the oversold threshold (30). This indicates bearish exhaustion and potential for bullish recovery. However, traders should look for confirmation from additional bullish candles before initiating buy positions.

MACD (Moving Average Convergence Divergence): MACD histogram bars are below the zero line but decreasing in magnitude, showing waning bearish momentum. The MACD lines are converging, suggesting a bullish crossover might occur soon, further reinforcing a potential bullish reversal.

Williams %R: Currently at -80.86, this indicator reflects oversold conditions, implying that selling pressure may diminish, giving way to an upward price reversal or retracement soon. Traders should look out for an upward movement in the indicator as confirmation.

Support and Resistance:

Support: Immediate key support is observed at 1.0813, where recent price actions formed significant pin bar candles indicating buying pressure.

Resistance: Initial resistance is identified at the middle Bollinger Band around 1.0850, followed by a stronger resistance at the upper Bollinger Band, around the 1.0900 psychological level.

Conclusion and Consideration:

EURUSD’s technical outlook on the H4 timeframe suggests a potential bullish reversal, supported by oversold conditions in the RSI and %R, and a reduction in bearish momentum on the MACD. Price action at the support level combined with today’s significant PMI reports and speeches by Fed officials could induce volatility. Traders should manage positions carefully, considering the fundamental news events today, which may substantially influence EURUSD price movements.

Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential.