Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The NZD/USD pair is currently reacting to several key fundamental factors. On the USD side, today’s upcoming press conference by US President Donald Trump and a speech by Federal Reserve Bank of Richmond President Thomas Barkin could drive volatility. Additionally, the US GDP report and unemployment claims data are scheduled for release, which will provide insight into the strength of the US economy. If these reports show stronger-than-expected numbers, the USD could strengthen, pushing NZDUSD lower. n the New Zealand Dollar (NZD) side, the ANZ Business Confidence Index is set for release, providing a key outlook on New Zealand’s economic sentiment. If the data signals economic optimism, it could support NZD gains. However, the lack of major market-moving news from New Zealand today suggests that the NZDUSD pair will likely be driven by USD fundamentals and broader market sentiment.

Price Action:

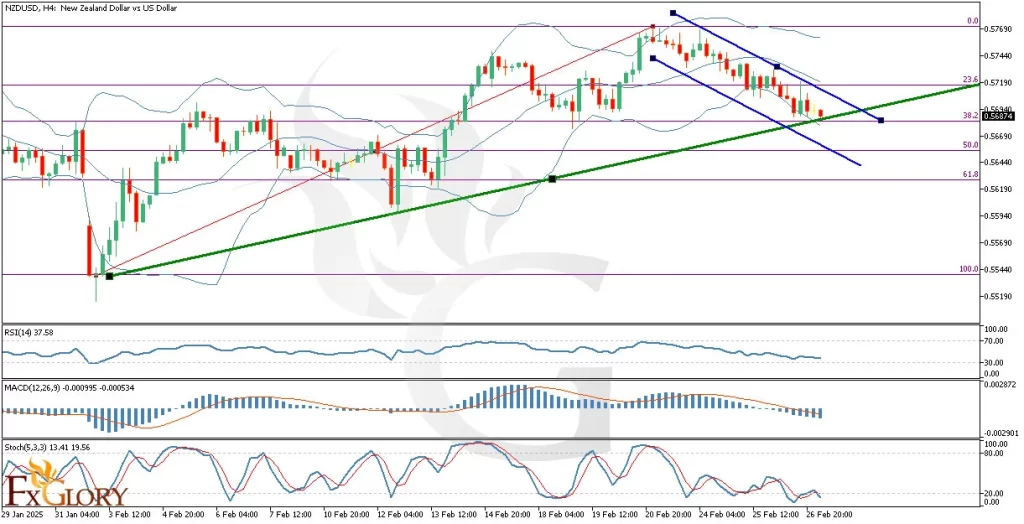

The NZD USD H4 chart indicates a bearish short-term trend, with the price forming multiple negative bearish candles and trading in the lower half of the Bollinger Bands. The pair recently touched the 38.2% Fibonacci retracement level, where some support has emerged, but the last candle remains bearish and red, confirming continued downside pressure. Despite the current bearish movement, the overall February 2025 trend has been bullish, suggesting that this pullback could be a correction rather than a full reversal. Traders should watch for buying interest at key support levels to confirm whether the larger uptrend will resume.

Key Technical Indicators:

Bollinger Bands: The price is trading in the lower half of the Bollinger Bands and is near the lower band, indicating strong bearish momentum. If the price fails to break lower, a bounce back toward the middle band could occur, signaling potential consolidation.

MACD (Moving Average Convergence Divergence): The MACD histogram is negative, with the MACD line positioned below the signal line, confirming bearish momentum. There is no bullish crossover yet, meaning further downside pressure is still in play.

RSI (Relative Strength Index): The RSI is currently at 37.58, nearing the oversold zone (below 30). This suggests that while the bearish trend is strong, there could soon be a slowdown or potential price reversal if RSI moves upward.

Stochastic Oscillator: The Stochastic (5,3,3) is at 19.56, deep in oversold territory. This often signals that the selling pressure may be exhausted, and a short-term bounce or correction could be on the horizon. However, confirmation is needed before entering long positions.

Support and Resistance Levels:

Support: The immediate 38.2% Fibonacci retracement level at 0.5680 serves as the nearest support. If broken, the next key support is at 0.5640 (50% Fibonacci level).

Resistance: The first resistance is at 0.5719 (23.6% Fibonacci level), and if the price breaks above this, further resistance is at 0.5760, near the recent highs.

Conclusion and Consideration:

The NZDUSD H4 analysis suggests that the short-term trend is bearish, with multiple bearish candles and downward pressure confirmed by key technical indicators. However, the overall February trend remains bullish, meaning this could be a pullback rather than a trend reversal. Traders should watch key support levels around 0.5680 and 0.5640, as a bullish reaction from these areas could indicate a continuation of the larger uptrend. On the fundamental side, the US GDP report, unemployment claims, and speeches from US officials will likely dictate today’s market direction. If USD strengthens, further NZD-USD declines are likely; however, weaker US data or optimistic NZD sentiment could support a reversal.

Disclaimer: The analysis provided for NZD/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on NZDUSD. Market conditions can change quickly, so staying informed with the latest data is essential.