Time Zone: GMT +2

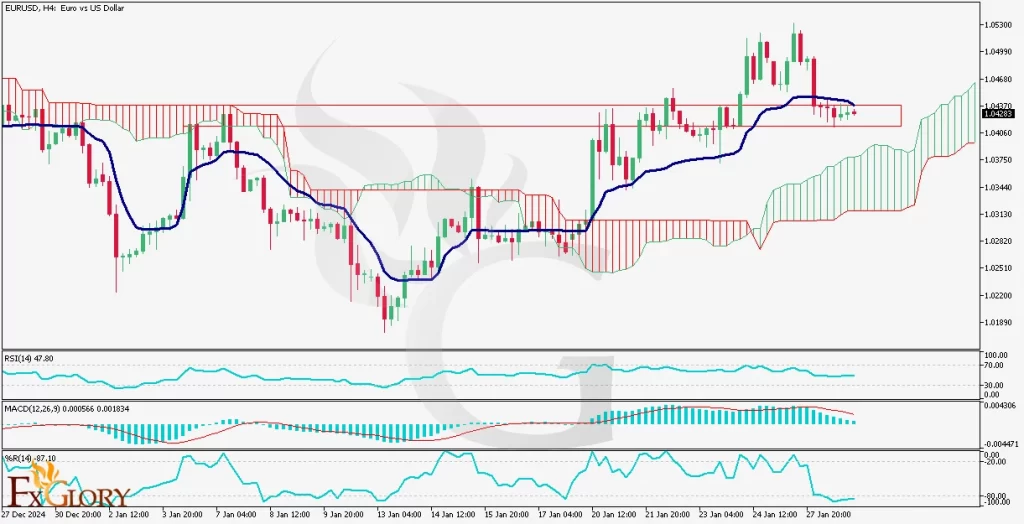

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/USD pair is currently at a crucial juncture, with traders anticipating key economic data releases from both the Eurozone and the United States. In the Eurozone, GDP First Estimate, Consumer Price Index (CPI), and Unemployment Rate are set to influence the euro’s performance. A stronger-than-expected GDP or CPI could reinforce bullish sentiment, whereas a higher unemployment rate may weaken the euro. On the U.S. side, market participants are focused on the Advance GDP report and Weekly Jobless Claims. If the GDP figure surpasses expectations, it could boost the USD by reinforcing hawkish Federal Reserve sentiment. Similarly, lower-than-expected jobless claims would signal labor market strength, supporting the dollar. However, any weak data may lead to renewed EUR/USD upside. Given the importance of these economic indicators, high volatility is expected in EUR/USD, with sharp moves possible based on data surprises.

Price Action:

The EUR/USD H4 price action indicates that the pair is consolidating within a strong support zone, following a recent decline. The break below the 30-period EMA suggests that bearish momentum is increasing, but the price is still holding above a key structural support level near 1.04139. If the support zone holds, a bullish rejection could trigger a rebound toward the next resistance at 1.04680. However, if sellers manage to push the price below this support, further declines toward the next key level may follow. The current market structure reflects indecision, requiring a breakout confirmation for directional bias.

Key Technical Indicators:

Ichimoku: The price is currently trading inside a key support zone, aligning with the last flat Senkou Span B and previous horizontal resistance at 1.04139. This area serves as a strong demand zone, and holding above it could trigger a bullish reversal. A break below would expose the next downside levels.

EMA 30: The 30-period EMA was broken by a strong bearish candle, suggesting potential downside continuation. However, price remains close to this moving average, signaling possible re-entry into the uptrend if reclaimed. A decisive move back above the EMA would favor bullish momentum, while continued rejection below it would reinforce bearish sentiment.

RSI (Relative Strength Index): The RSI is currently at 47.80, showing neutral momentum. It is neither in overbought nor oversold territory, indicating lack of strong directional bias. A move above 50 would favor bullish continuation, while a decline below 40 would confirm increasing bearish pressure.

MACD (Moving Average Convergence Divergence): The MACD histogram is weakening, with the MACD line nearing a bearish crossover with the signal line. This suggests that momentum is tilting toward the downside. If the MACD line crosses below the signal line, it may confirm further bearish momentum, whereas an upward move in the histogram could indicate a potential bullish shift.

%R (Williams %R): The Williams %R is at -87.10, signaling an oversold condition. This suggests that a short-term bounce or reversal is possible. However, if the pair remains in this oversold territory for an extended period, it could indicate further downside continuation. A move above -80 would suggest recovery potential.

Support and Resistance Levels:

Support: A strong demand zone is located at 1.04139, which aligns with a previous resistance-turned-support and the last flat Senkou Span B level. This is a critical area for buyers to hold to prevent further declines. If the price breaks below, the next key support is at 1.03750, which aligns with previous price action and may serve as the next target for sellers.

Resistance: The first level of resistance is at 1.04680, near the 30 EMA, acting as a dynamic barrier for bullish attempts to regain control. A sustained move above this level could shift momentum toward the upside. If buyers push the price higher, the next major resistance is at 1.05300, which represents the recent swing high and would need to be cleared for continued bullish movement.

Conclusion and Consideration:

The EUR/USD H4 chart analysis indicates that the pair is at a crucial support zone, with price action suggesting either a bullish reversal or a continuation of the bearish move. The break below the 30 EMA and weakening MACD favor a potential downside move, but the oversold %R and neutral RSI indicate that a reversal is also possible. Traders should closely monitor the Eurozone GDP and CPI data, as well as U.S. GDP and Jobless Claims, as these will determine the pair’s next significant move. If the support at 1.04139 holds, the pair could stage a recovery toward 1.04680, while a break below this level could trigger further downside toward 1.03750. For trading setups, waiting for a confirmed breakout above resistance or below support is essential. A bounce from support may offer buying opportunities, while a confirmed breakdown could provide short-selling setups.

Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential.