Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GBP/AUD forecast today is influenced by a mix of economic indicators from both the UK and Australia that paint a complex picture of the potential market directions. The UK sees a decrease in Claimant Count Change and a slight uptick in the Unemployment Rate, combined with a reduction in the Average Earnings Index. In contrast, Australia’s economic indicators such as the Westpac Consumer Sentiment and NAB Business Confidence show a mixed economic sentiment, while the Wage Price Index suggests rising wage pressures. These data releases provide critical insights into the economic health of both nations, influencing the GBP/AUD trading strategy.

Price Action:

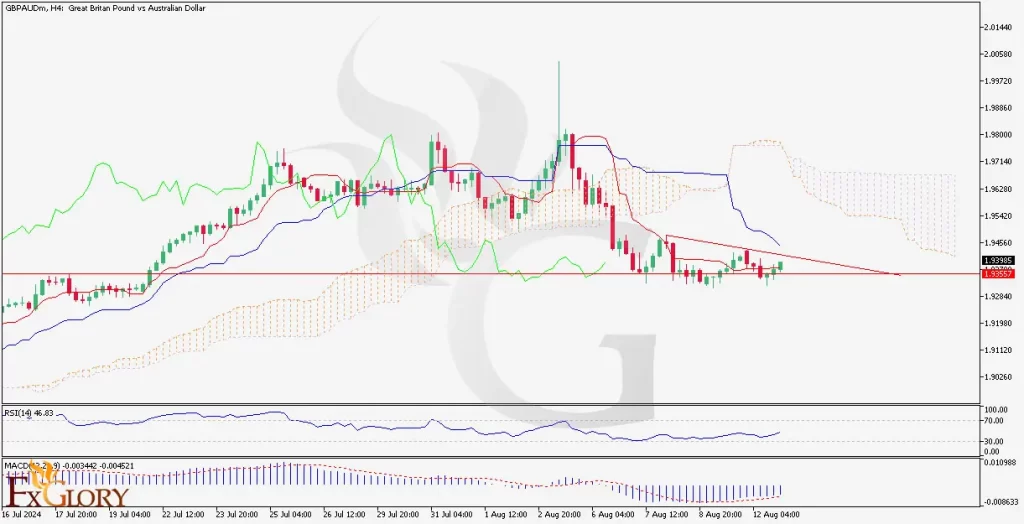

The GBP/AUD pair has been experiencing a bearish wave but shows signs of potential reversal. The price action is forming a descending triangle, with recent lows higher than previous ones, indicating weakening downward momentum. Traders should closely monitor this pattern for a breakout which could signal a new trend.

Key Technical Indicators:

MACD (Moving Average Convergence Divergence): The MACD indicates a decline in bearish momentum with the histogram showing less negativity, suggesting a potential shift towards a bullish market phase if the descending triangle resistance is breached.

RSI (Relative Strength Index): The RSI nears 45 and shows signs of a bullish reversal, which aligns with the weakening bearish momentum observed in the price action. This suggests that the current bearish trend might be losing strength.

Support and Resistance:

Support Levels: Immediate support is located at 1.50000. This level is critical as it has been tested recently and held firm, indicating strong buying interest.

Resistance Levels: The nearest resistance level is at 1.50313, followed by 1.49961, which aligns with recent highs and the descending trend line.

Conclusion and Consideration:

The GBP/AUD H4 chart suggests that the bearish momentum is fading with key economic indicators and technical signals pointing towards a possible trend reversal. The outcome of the current patterns could be significantly influenced by further economic releases and market sentiment. Traders should maintain vigilance and adjust their strategies based on the evolving market conditions and economic data.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.