Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The AUD/USD news analysis today is influenced by a combination of economic indicators and geopolitical factors. For the Australian dollar, key factors include the Westpac Consumer Sentiment Index and the NAB Business Confidence survey. Both indicators reflect the economic health and confidence levels within Australia, affecting the currency’s strength. Additionally, the upcoming testimony from Federal Reserve officials and other USD-related economic data, such as the NFIB Small Business Index, will significantly impact the US dollar. Statements from Federal Reserve members can provide insights into future monetary policy, influencing the USD and, consequently, the AUD/USD forecast today.

Price Action:

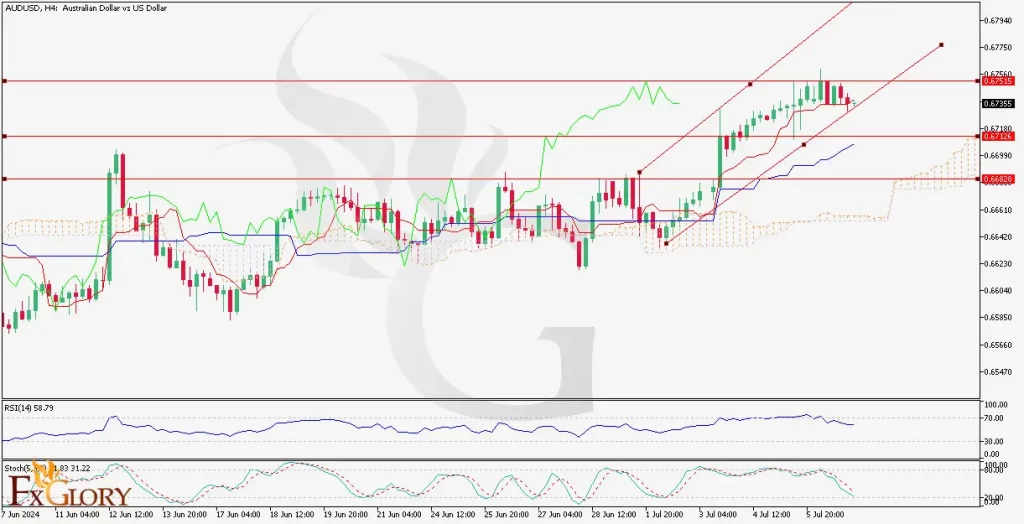

The AUD/USD H4 chart is displaying an uptrend characterized by higher highs and higher lows. The price has been moving within an ascending channel, currently consolidating near the upper boundary. This indicates that the bullish momentum of the “Aussie” is still intact, but the pair is facing some resistance. The price action of the pair suggests a potential breakout above the current resistance levels if the bullish pressure persists.

Key Technical Indicators:

Ichimoku Cloud:The price is trading above the Kumo (cloud), indicating a bullish trend. The Senkou Span A is above Senkou Span B, further supporting the bullish sentiment.

RSI (Relative Strength Index):The RSI is currently at 58.79, which is in the bullish territory but not overbought. This suggests there is still room for the price to move higher.

Stochastic Oscillator:The Stochastic (5, 3, 3) is at 21.83, indicating that the pair might be oversold in the short term, potentially leading to a reversal or continuation of the bullish trend if it crosses above 20.

Support and Resistance:

Support: The nearest support level is at 0.67126, followed by a more substantial support level at 0.66892.

Resistance: The nearest support level is at 0.67126, followed by more substantial support at 0.66892.

Conclusion and Consideration:

The AUD/USD technical analysis today shows the pair’s strong bullish trend on the H4 chart, supported by the Ichimoku cloud analysis and the current position of the RSI. The Stochastic indicator suggests potential short-term oversold conditions, which might lead to a continuation of the bullish trend if the pair finds support at current levels. Traders should monitor key support and resistance levels, especially the 0.67355 and 0.67515 resistance levels, for potential breakout opportunities. Given the upcoming economic data releases and speeches from Federal Reserve officials, traders should remain cautious and employ proper risk management strategies.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.