Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/USD news analysis today is influenced by significant economic indicators and news releases. For the Euro, the M3 Money Supply and private loans data provide insights into economic health and lending trends within the Eurozone. For the US Dollar, today’s high-impact news includes the Final GDP q/q, expected at 1.4%, and Unemployment Claims forecasted at 236K. Stronger-than-expected GDP growth and lower unemployment claims are likely to support the USD, while weaker data could benefit the Euro. Additionally, medium-impact releases such as Core Durable Goods Orders and Durable Goods Orders will further influence the EUR/USD market sentiment and direction.

Price Action:

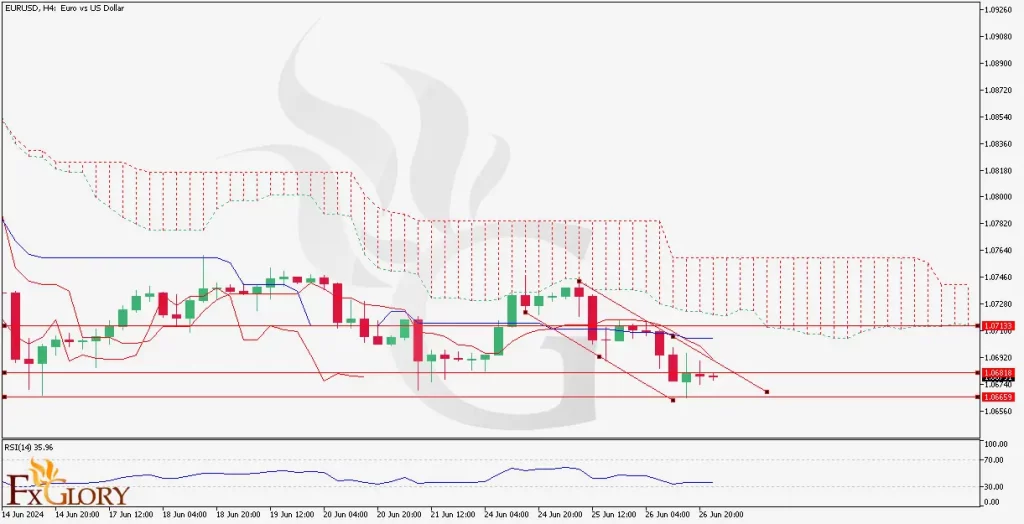

The EUR/USD H4 chart exhibits a bearish trend for the pair, with the price making lower highs and lower lows. The pair has recently been trading below the Ichimoku Cloud, indicating sustained bearish momentum. The “Fiber’s” price action shows a potential descending triangle pattern, which could signal further downside if support levels are breached.

Key Technical Indicators:

Ichimoku Cloud: The price is below the Ichimoku Cloud, suggesting a bearish trend. The future cloud is also red, indicating potential continued bearish sentiment.

RSI (Relative Strength Index): The RSI is currently at 35.96, indicating that the pair is approaching oversold territory. This could suggest a potential for a short-term reversal if the RSI dips further but fails to break the oversold threshold.

Support and Resistance:

Support Levels: The immediate support level is at 1.06650, followed by a secondary support at 1.06550.

Resistance Levels: The nearest resistance is at 1.07139, with further resistance at 1.07640 and 1.08000.

Conclusion and Consideration:

The EUR/USD forecast live shows strong bearish momentum, as evidenced by the position below the Ichimoku Cloud and the descending RSI. Traders should monitor the key support level at 1.06650; a breach below this level could signal further downside. Conversely, if the RSI indicates oversold conditions, a short-term bounce to the resistance levels could occur. Fundamental factors, including today’s economic releases, will play a crucial role in determining the pair’s direction. Proper risk management, including setting stop losses, is essential due to potential market volatility around high-impact news.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.