Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GBP/USD news analysis today is influenced by a variety of fundamental factors including economic indicators from both the UK and the US. Upcoming key events include the Bank of England’s Monetary Policy Committee meeting minutes and US unemployment claims. The BOE’s stance on interest rates and the MPC’s vote distribution will provide insight into future monetary policy, which is crucial for currency valuation. In the US, unemployment claims are expected to be around 235K, with lower actual figures generally being positive for the USD. Additionally, housing data and manufacturing indices from the US will provide further economic context that can impact the pair.

Price Action:

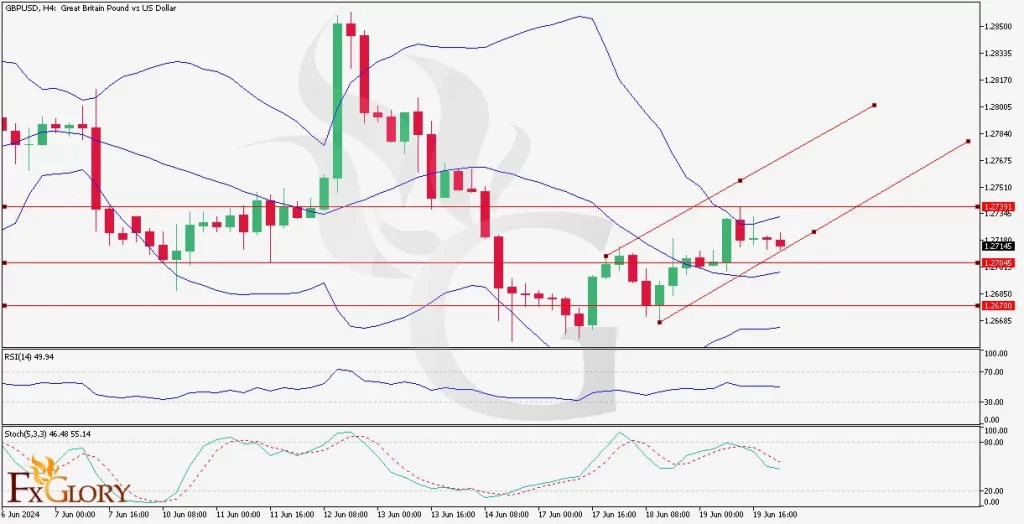

The GBP/USD H4 chart shows a recent bullish trend within a rising channel, with prices attempting to break above the resistance level at 1.27391. The GBP/USD technical analysis today shows the pair has been making higher lows, indicating buying interest. However, the bullish momentum appears to be facing challenges at the current resistance, leading to potential consolidation or a pullback if the resistance holds firm.

Key Technical Indicators:

Bollinger Bands: The price is approaching the upper Bollinger Band, indicating that the currency pair might be entering an overbought territory. This can act as a dynamic resistance level.

Stochastic Oscillator: The Stochastic Oscillator is at 46.48, approaching the overbought threshold. This can signal that a price correction might be imminent if the overbought level is reached.

RSI (Relative Strength Index): The RSI is at 49.94, suggesting a neutral to slightly bullish momentum. This indicates that there is still room for the price to move higher before hitting overbought conditions.

Support and Resistance:

Support Levels: Immediate support is at 1.27045, with a stronger support level at 1.26780.

Resistance Levels: Immediate resistance is at 1.27391. A break above this level could target higher resistances within the rising channel.

Conclusion and Consideration:

The GBP/USD forecast today depicts the pair to be exhibiting bullish tendencies within a rising channel, supported by neutral to bullish RSI and Stochastic indicators. Traders should watch for a breakout above the resistance at 1.27391 to confirm continued bullish momentum. Given the upcoming fundamental events, particularly from the Bank of England and US economic data, traders should stay vigilant as these can cause significant volatility. Setting appropriate stop-loss levels and monitoring key support and resistance zones is crucial in managing risk.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.