Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The NZD/CAD news analysis today highlights the impact of various economic factors and central bank policies. The Reserve Bank of New Zealand (RBNZ) has recently adopted a more dovish stance due to concerns over economic growth, while the Bank of Canada (BoC) is focusing on inflation control, supported by recent positive economic data. These divergent approaches are key to understanding the NZD/CAD dynamics. The RBNZ’s dovish tone could weaken the NZD, whereas the BoC’s hawkish policies might strengthen the CAD.

Price Action:

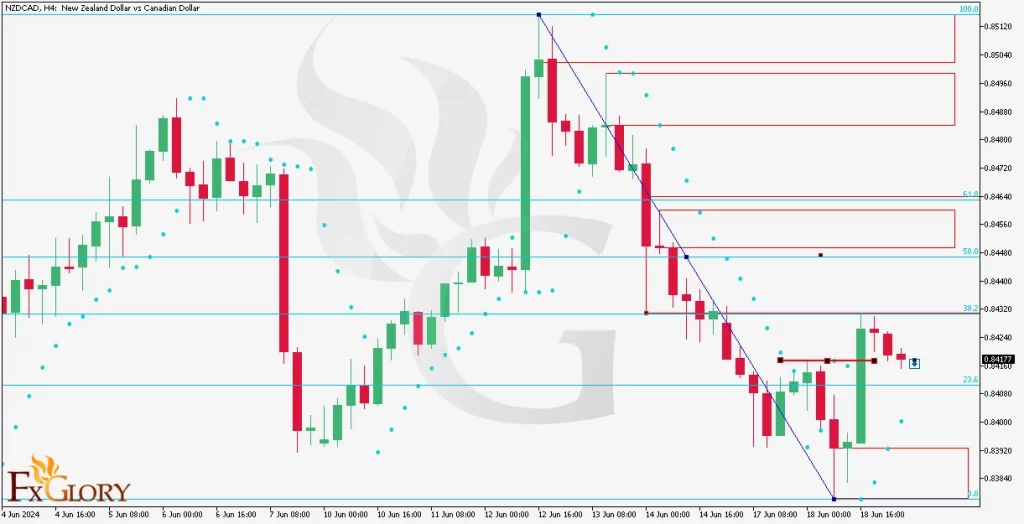

The NZD/CAD H4 chart reveals a market that was initially bearish but has shown signs of a bullish reversal after a Change of Character (CHOCH). The price action demonstrates a shift from lower lows to higher highs, confirming the trend reversal. The current price suggests a bullish trend with a target set above the previous order block. For further confirmation, we use the RSA Parabolic indicator, where the dots below the candles indicate a buy signal.

Key Technical Indicators:

RSA Parabolic: The dots below the candlesticks provide a clear buy signal, suggesting bullish momentum. This indicator is essential for confirming the trend reversal and potential upward movement.

Support and Resistance:

Support Levels:

Immediate support is at 0.8410, aligning with the recent lows. Additional support can be found at 0.8380.

Resistance Levels:

Immediate resistance is at 0.8450, followed by significant resistance at 0.8480 and 0.8500.

Conclusion and Consideration:

The NZD/CAD chart forecast is bullish, as indicated by the recent CHOCH and supporting technical indicators. Traders should consider going long, targeting the order block levels mentioned above. The NZDCAD forecast is strengthened by the bullish signals from the RSA Parabolic. Fundamental factors, such as the policies of RBNZ and BoC, will continue to influence the pair’s movements. Traders should use risk management strategies and be mindful of the volatile nature of the forex market. Staying updated with the latest NZD CAD analysis on TradingView and monitoring NZD CAD news analysis can provide further insights.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.