Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The USD/JPY currency pair is currently experiencing significant movements influenced by upcoming Japanese economic data releases; making this currency pair eye-catching for forex traders looking for buy oppertunity. Key financial news on this pair include:

- BOJ Policy Rate: Expected to remain steady at <0.10%.

- Monetary Policy Statement and BOJ Press Conference: Crucial for insights into future monetary policies.

- Revised Industrial Production m/m: Forecasted at -0.1%, identical to the previous figure.

- Tertiary Industry Activity m/m: Anticipated to rise to 0.4% from a previous -2.4%.

These data points are vital as they provide insights into Japan’s economic health, impacting the JPY’s strength and subsequently the USD/JPY exchange rate.

Price Action:

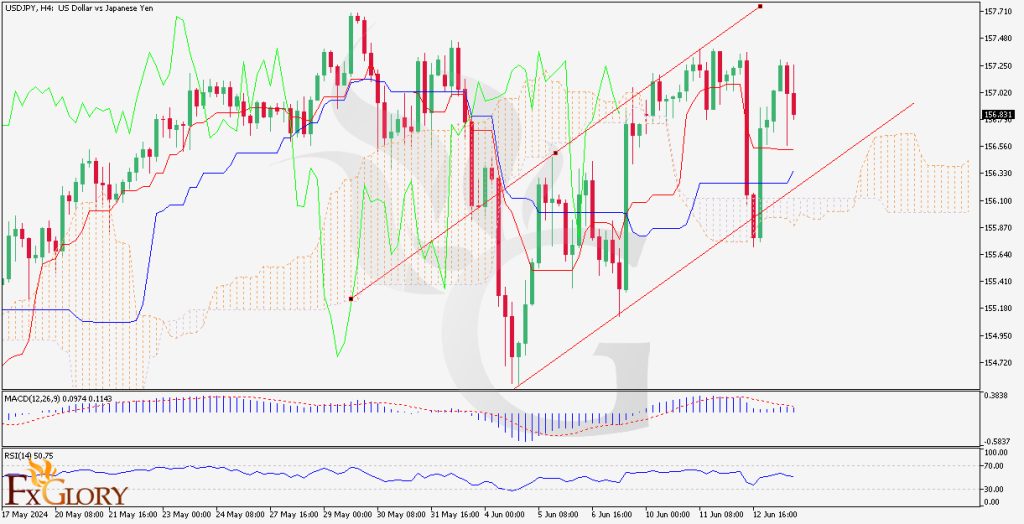

The USD/JPY H4 chart highlights a recent break above the Ichimoku cloud, signaling a potential bullish trend. The formation of higher highs and higher lows suggests the establishment of a bullish channel. Traders seeking for bullish trade opportunities should monitor for confirmation of this trend to gauge future price movements.

Key Technical Indicators:

Ichimoku Cloud: The price has recently broken above the Ichimoku cloud, indicating a bullish trend. The Tenkan-sen (conversion line) is above the Kijun-sen (base line), further supporting the bullish outlook.

MACD: The Moving Average Convergence Divergence (MACD) shows bullish signals with the histogram above the zero line and the MACD line above the signal line, indicating sustained bullish momentum.

RSI: The Relative Strength Index (RSI) is hovering around 50.75, suggesting moderate bullish momentum without being overbought, which allows room for further upward movement.

Support and Resistance:

Support Levels: Immediate support is at the lower points of recent candles around 155.410.

Resistance Levels: The upper boundary of the current bullish channel near recent highs around 157.710 acts as resistance.

Conclusion and Consideration:

raders should closely watch both the upcoming Japanese economic news and the USD/JPY reaction at key support and resistance levels. The continuation of the bullish trend could present buying opportunities, while any signs of reversal or consolidation might require strategic adjustments. Staying updated with the latest economic reports is essential for effectively navigating the volatile forex market. By monitoring these dynamics, traders can better anticipate the USD/JPY pair’s movements and make informed trading decisions.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.