Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Today’s economic releases for Japan include low-impact indicators such as Bank Lending y/y, Current Account, Final GDP Price Index y/y, Final GDP q/q, and Economy Watchers Sentiment. The USDJPY news analysis today suggests a generally stable economic environment with no significant surprises expected. The USD has no major releases today, indicating a relatively quiet day on the fundamental front, potentially leaving the currency pair more susceptible to technical movements and broader market sentiment.

Price Action:

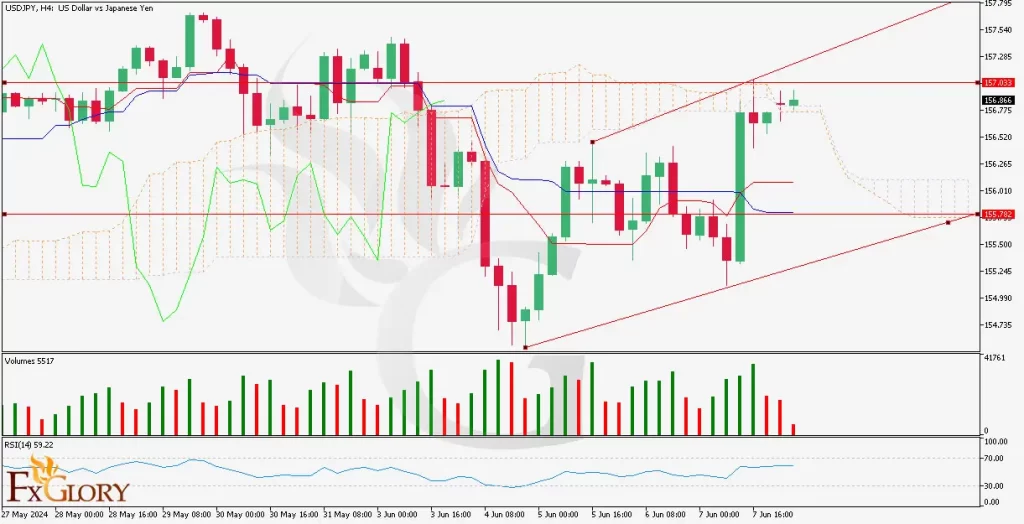

On the H4 chart, the USDJPY forecast live today shows a recent recovery from a dip, moving upwards and breaking past several key levels. The pair is currently trading above the Ichimoku cloud, suggesting a bullish bias. The recent candles have higher highs and higher lows, indicating a potential continuation of this upward momentum.

Key Technical Indicators:

Ichimoku Cloud: The price has broken above the cloud, with the Tenkan-sen (blue line) crossing above the Kijun-sen (red line), indicating a bullish trend. The leading span lines are showing a widening, which supports the bullish momentum.

Volume: There has been an increase in buying volume, which supports the recent upward price movement. This rise in volume suggests that the market participants are confident in the upward trend.

RSI (Relative Strength Index): The RSI is currently at 59.22, indicating moderate bullishness. It is not yet in the overbought territory, suggesting there is still room for further upside.

Support and Resistance:

Support Levels: The immediate support level is at 155.782, which aligns with the lower boundary of the upward trend channel.

Resistance Levels: The key resistance level is at 157.033. A break above this level could indicate a continuation of the bullish trend.

Conclusion and Consideration:

The USDJPY fundamental analysis today on the H4 chart displays signs of a bullish reversal, supported by positive signals from the Ichimoku cloud and increasing volume. The RSI suggests room for further gains, while the trendlines provide clear levels to watch for support and resistance. Traders should monitor for a breakout above the 157.033 resistance level to confirm continued bullish momentum. Considering the moderate impact of today’s economic releases from Japan, the market’s technical aspects are likely to dominate the price action.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.