Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The recent news includes key economic indicators from both the Eurozone and the US that could significantly affect the EUR/USD exchange rate. On May 29th, the Eurozone will release the German Prelim CPI m/m, a crucial indicator of inflation trends in Europe’s largest economy. For the US, significant data releases on May 30th include the Prelim GDP q/q with a forecast of 1.3% against the previous 1.6%, and Unemployment Claims expected to come in at 218K compared to the previous 215K. These economic indicators are essential to watch, as they provide insights into the economic health of both regions, influencing currency strength.

Price Action:

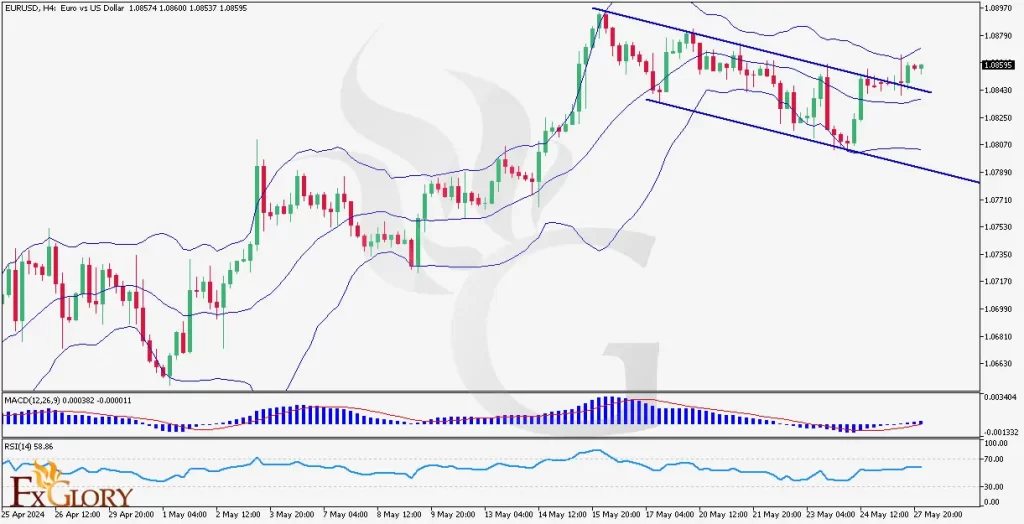

The EUR/USD H4 chart currently shows that the price has broken out of its bearish channel, which could indicate the end of the correction phase and suggest the potential for another bullish leg. The breakout from the bearish channel suggests a possible shift in momentum towards the upside. Traders should watch for confirmation of this breakout with sustained movement above the upper channel line, indicating the continuation of the bullish trend.

Key Technical Indicators:

MACD: The Moving Average Convergence Divergence (MACD) shows a lack of bearish momentum, with the histogram tightening and the MACD line showing signs of turning upwards. This could indicate a potential shift in the EUR/USD current trend towards bullishness.

RSI: The Relative Strength Index (RSI) is hovering around 58, which is slightly above neutral, indicating a mild bullish bias without being in overbought territory, suggesting room for further upward movement.

Support and Resistance Levels:

Support: The lower points of the recent candles around 1.08300 serve as the immediate support level.

Resistance: The upper line of the former bearish channel around 1.08750 acts as a resistance level.

Conclusion and Consideration:

Traders should closely monitor both the upcoming economic news and the GBPUSD reaction at the 1.26000 resistance level. A failure to break through could confirm the bearish price prediction, leading to potential short opportunities. Conversely, a strong push above this level could invalidate the bearish scenario for this pair. Given these dynamics, it’s essential to stay updated with the latest economic reports and adjust strategies accordingly to navigate the volatile forex market effectively.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.