Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GBP/CAD currency pair reflects the exchange rate between the British Pound and the Canadian Dollar. Fundamental drivers include economic indicators such as consumer confidence, retail sales, and corporate profits. Today, low-impact data from the UK shows GfK Consumer Confidence better than forecasted, which is positive for GBP currency. However, high-impact retail sales data is expected, which could provide significant market movement. On the Canadian side, core retail sales and overall retail sales are anticipated, with both having the potential to impact the CAD. Traders should keep a close eye on these releases as they are pivotal in understanding market sentiment and economic health.

Price Action:

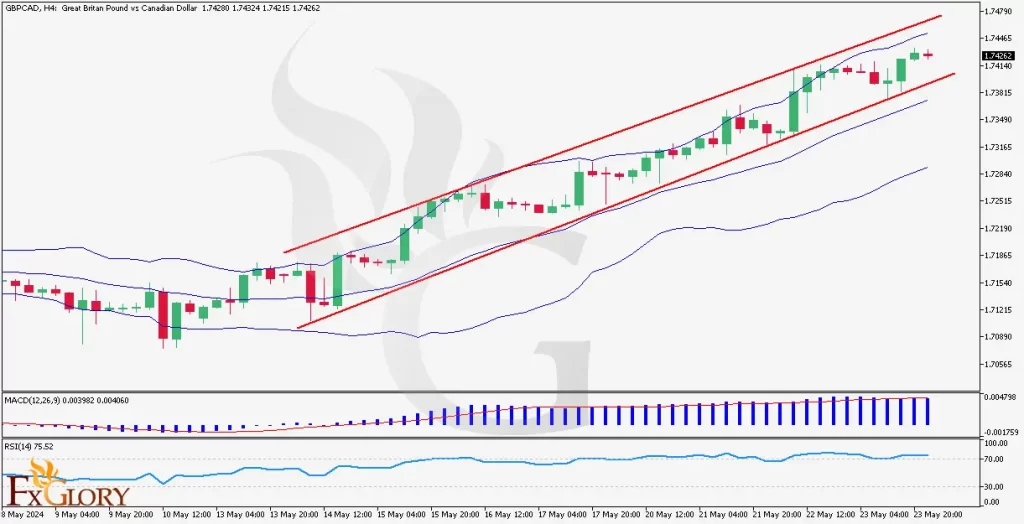

The GBPCAD pair analysis in the H4 timeframe has been showing a bullish trend, characterized by consistent upward movement and price action primarily above previous resistance levels. The pair has been adhering to a series of higher highs and higher lows, reflecting strong buying momentum. Recently, price action has been navigating the upper Bollinger Bands, indicating strong upward pressure and a potential overbought condition in the short term.

Key Technical Indicators:

Bollinger Bands: The candles have been moving on the upper side of the Bollinger Bands for the past 10 days, signaling a strong bullish momentum. This indicates that the pair might be overextended and could face a correction if it doesn’t break above the upper band convincingly.

MACD (Moving Average Convergence Divergence): The MACD line is above the signal line and situated well above the zero line, showing strong bullish momentum. This suggests that the buying pressure remains robust, but traders should watch for any divergence or a potential crossover that might indicate a weakening trend.

RSI (Relative Strength Index): The RSI is hovering above 70, indicating that the pair is in overbought territory. This suggests a potential for a corrective pullback or consolidation as the market might need to absorb the recent gains before continuing its upward trajectory.

Support and Resistance:

Support: The immediate support level is found around 1.73700, where the price has previously found buyers and rebounded.

Resistance: The current resistance level is around 1.74600, a psychological level and the recent high, which might be tested if the bullish momentum continues.

Conclusion and Consideration:

The GBPCAD pair on the H4 chart shows strong bullish momentum, underpinned by the GBPCAD’s technical indicators and price action analysis. The Bollinger Bands, MACD, and RSI all point to a continuation of the upward trend, though the RSI warns of a possible short-term correction. Traders should monitor the upcoming economic data releases closely, as they can provide crucial insights and potentially trigger significant price movements. It is prudent to consider risk management strategies given the potential volatility from the economic news.

Disclaimer: The GBPCAD’s provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions. The market conditions can change rapidly, and it is essential to stay updated with the latest information.