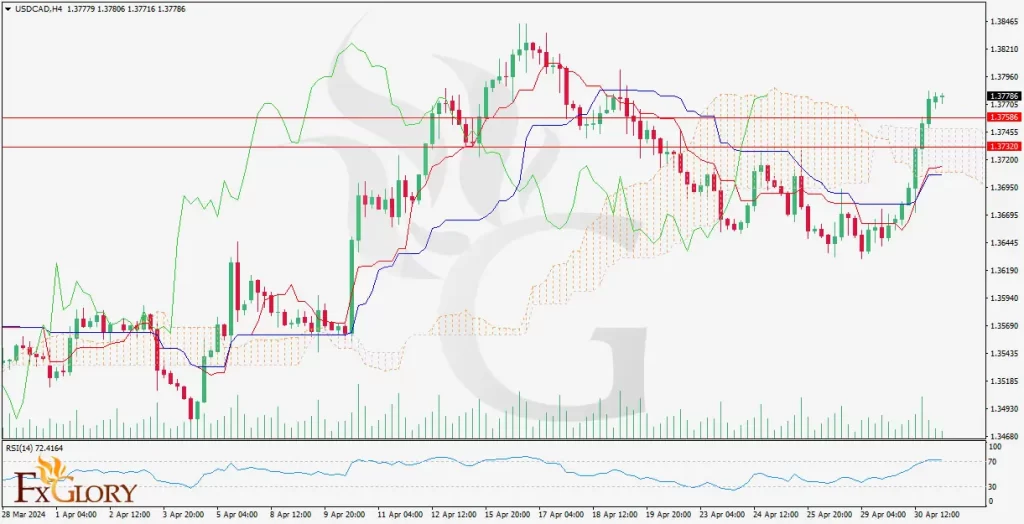

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The USD/CAD pair reflects the economic interplay between the United States and Canada, with factors like oil prices, trade policies, and relative economic performance playing significant roles. The strength of the US dollar is influenced by America’s economic indicators, Federal Reserve policies, and global market sentiment. Conversely, the Canadian dollar often reacts to shifts in commodity prices, especially crude oil, given Canada’s status as a major exporter. Additionally, economic data releases from both countries, such as employment statistics and GDP reports, provide critical context for currency valuation.

Price Action:

The recent price action on the USD/CAD H4 chart shows a pronounced upward movement, breaking past previous resistance levels. This rally indicates a strong bullish sentiment, potentially driven by favorable economic data or shifts in risk appetite. The price has just breached the Ichimoku Cloud, suggesting a shift from a bearish to a bullish market environment.

Key Technical Indicators:

Ichimoku Cloud: The price moving above the Ichimoku Cloud indicates a potential change in trend from bearish to bullish.

RSI: The Relative Strength Index is approaching 70, pointing towards increasing bullish momentum, though nearing overbought conditions which could suggest a future pullback or consolidation.

Volume: There is a noticeable increase in trading volume accompanying the price rise, supporting the strength of the current move.

Support and Resistance:

Support: The key support level now sits at the top boundary of the Ichimoku Cloud, around 1.3720, which could serve as a new baseline for the currency pair.

Resistance: The next major resistance level is near the recent high around 1.3785, which might challenge further upward movements.

Conclusion and Consideration:

The USD/CAD pair, in the current H4 timeframe, exhibits a bullish trend with strong upward momentum as indicated by the breakout above the Ichimoku Cloud and supported by robust volume. Traders should consider the potential for overbought conditions as indicated by the RSI and prepare for possible resistance at higher levels. Monitoring upcoming economic releases from both the U.S. and Canada will be crucial in maintaining an informed trading strategy. Effective risk management remains essential, given the inherent volatility in the forex market.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Traders should perform their own due diligence before making any investment decisions. own research and analysis before making any trading decisions.