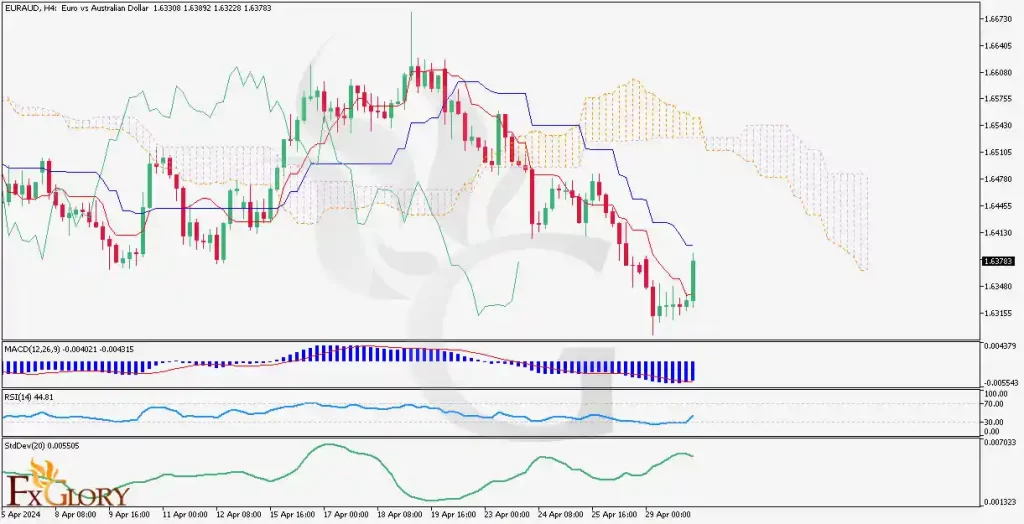

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/AUD pair is greatly influenced by the economic health and monetary policies of the Eurozone and Australia. Interest rate differentials, economic growth disparity, and global risk sentiment are key drivers. Europe’s energy situation and Australia’s export performance, particularly in minerals and resources, provide additional context. The Euro might be pressured by internal political dynamics, while the Australian Dollar might react to commodity cycles and trade relationships, especially with China.

Price Action:

The downtrend indicated in the H4 chart has shown signs of a potential pause or reversal, with the last candle closing positively and the ongoing candle showing a sharp rise. This could indicate buying pressure entering the market, suggesting a bullish retracement or even a reversal if further bullish candles follow.

Key Technical Indicators:

Ichimoku Cloud: Price below the cloud suggests a bearish trend; however, a short-term bullish signal might be emerging if price breaks above the cloud.

MACD: Current positioning below the signal line points to bearish momentum, but convergence towards the signal line could indicate weakening bearish momentum.

RSI: Slightly below the mid-point at 44.81, suggesting neither overbought nor oversold conditions, aligning with a potential turning point in market sentiment.

Standard Deviation (StdDev): Low StdDev points to a consolidating market, which could precede a breakout.

Support and Resistance:

Support: The chart suggests 1.6375 as a recent support level where the price has shown some rebound.

Resistance: Resistance is anticipated around 1.6450, indicated by recent price peaks and the Ichimoku cloud’s lower boundary.

Conclusion and Consideration:

The EUR/AUD pair, in the current H4 timeframe, suggests a bearish trend with potential early signs of a bullish correction. The recent positive closure of a candle and an ongoing sharp rise could provide opportunities for a bullish entry with caution. Traders should closely monitor upcoming fundamental data releases affecting both the Euro and the Australian Dollar. It is essential to apply prudent risk management, considering the volatility inherent in the forex market.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Traders should perform their own due diligence before making any investment decisions. own research and analysis before making any trading decisions.