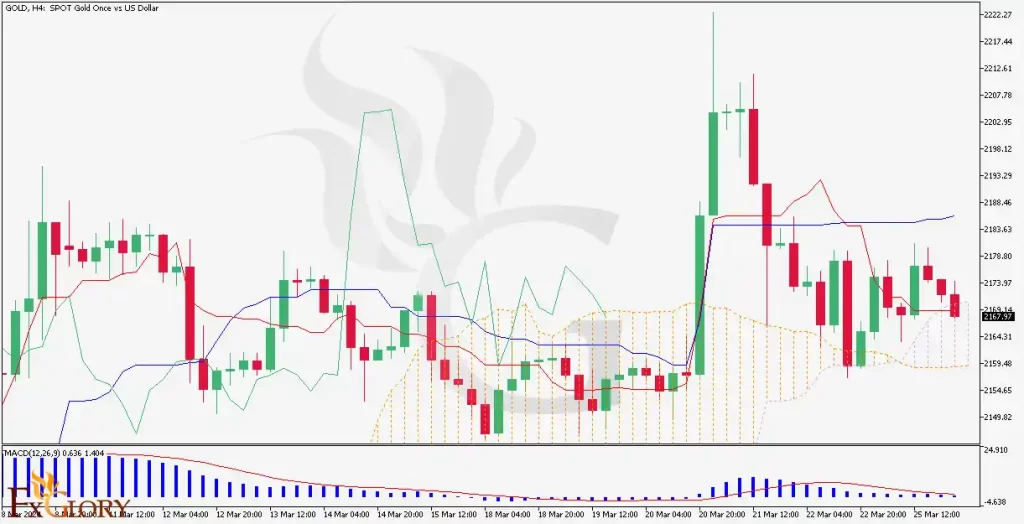

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Gold, as a traditional safe-haven asset, is impacted by global economic conditions, monetary policies, and geopolitical tensions. Interest rate changes and inflationary pressures can significantly influence gold prices. The demand for gold from consumers, investors, and central banks also plays a pivotal role in its valuation. Currently, market sentiment towards gold could be driven by such fundamental factors.

Price Action:

The GOLD H4 chart shows a fluctuating trend with a recent sharp rise followed by consolidation. This pattern reflects a market with mixed sentiment, where both buyers and sellers are struggling for dominance. The latest candlesticks are relatively small and close to each other, indicating indecision in the market.

Key Technical Indicators:

MACD (Moving Average Convergence Divergence): The MACD histogram is below the baseline, suggesting bearish momentum. However, the lines are converging, indicating a potential shift in momentum.

Ichimoku Kinko Hyo: The price is currently below the Ichimoku cloud, which could be interpreted as bearish. The recent crossover of the Tenkan-sen above the Kijun-sen may hint at a possible change in trend.

Support and Resistance:

Support: The nearest support level is around the recent lows where the price has shown a reluctance to move lower.

Resistance: Resistance can be identified at the level where the price has peaked before retracting, indicating a level where selling pressure begins to outweigh buying pressure.

Conclusion and Consideration:

The H4 chart for GOLD shows a market experiencing volatility with a tendency towards bearish momentum as indicated by the MACD and the price position relative to the Ichimoku cloud. However, the recent bullish crossover in the Ichimoku indicator and the consolidation in price action suggest a cautious approach. Traders should stay alert for signs of a definitive trend and consider global economic indicators, central bank policies, and geopolitical developments that could impact gold prices. Proper risk management is essential given the unpredictability of gold markets.

Disclaimer: This analysis is intended for informational purposes only and should not be taken as investment advice. Trading decisions should be based on individual risk tolerance, market knowledge, and thorough analysis.