Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GBPAUD pair reflects the economic dynamics between the United Kingdom and Australia. Key factors that may influence the pair include the divergence in monetary policies of the Bank of England and the Reserve Bank of Australia, trade balance data, and commodity prices, particularly metals and minerals which are significant to the Australian economy. Brexit-related news continues to affect the GBP, while employment data, GDP growth, and investor sentiment towards global risk play roles for the AUD. The Australian Dollar’s correlation with Asian markets can also contribute to its volatility against the British Pound.

Price Action:

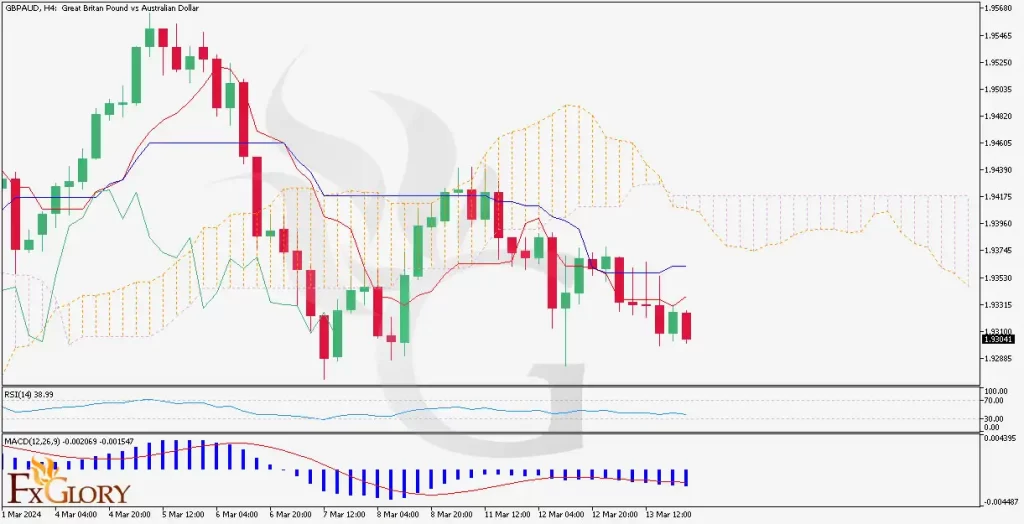

The H4 chart for GBPAUD shows a prevailing downtrend as evidenced by the recent series of lower highs and lower lows. The price action remains below the Ichimoku cloud, indicating bearish sentiment in the medium-term perspective. A downward price channel appears to be forming, suggesting continued control by sellers.

Key Technical Indicators:

Ichimoku Kinko Hyo: The price is below the Ichimoku cloud and the Chikou Span is below the price action from 26 periods ago, reinforcing the bearish outlook.

RSI (Relative Strength Index): The RSI is below 40, hinting at bearish momentum with potential room for further downside before becoming oversold.

MACD (Moving Average Convergence Divergence): The MACD histogram is below the baseline, and the signal line is above the MACD line, which suggests bearish momentum is ongoing.

Support and Resistance:

Support: The recent low at approximately 1.93285 acts as immediate support, with further potential support around the 1.92885 level.

Resistance: Resistance can be identified around the 1.94715 level, where the price has previously encountered selling pressure. Additional resistance may emerge near the bottom edge of the Ichimoku cloud.

Conclusion and Consideration:

The GBPAUD pair on the H4 timeframe presents a bearish scenario, with the Ichimoku, MACD, and RSI indicators all aligning to indicate downward momentum. Given the current price action, a test of lower support levels seems plausible. Traders should consider the impact of upcoming economic releases from both the UK and Australia, as well as global risk sentiment, when planning trades. It’s crucial to employ sound risk management strategies and to be prepared for volatility spikes that could arise from unexpected geopolitical or economic developments.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.